Home Loans

PAGE 2

Special Home Loans

Did you know that as a disabled veteran, you may be eligible for special considerations when getting a VA loan? It’s true. There are additional benefits available based on your disability status that could help you save quite a bit. Check out some of the benefits on a VA loan that come with your disability status. The VA Loan Funding Fee Is Waived If you currently receive disability…

Read more

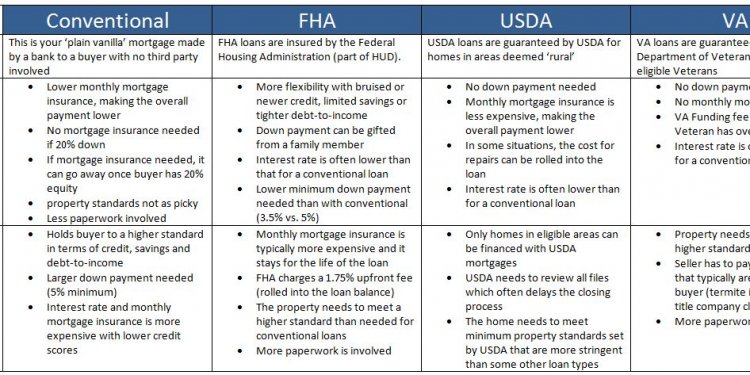

Types of Home Mortgage Loans

Can I get a conventional mortgage loan after bankruptcy? If you have been discharged from a Chapter 7 bankruptcy for four years or more, you are eligible to apply for a conventional mortgage loan. If you have had a Chapter 13 bankruptcy, you must have documentation that your credit reputation has been re-established for at least two years. When are adjustable rate mortgages…

Read more

Home loan help

Tip 3: Your Credit Score Isn’t Your Credit Score Your free credit report will not contain your credit score. This is something you have to pay to see, and as far as mortgages go it’s often best to not waste your money. That’s because lenders see different scores than consumers, and they use a formula weighted especially for mortgage lending. What your loan specialist pulls…

Read more

Home Mortgage Company

You understand what it means to serve. So do we. Prosperity Home Mortgage, LLC, (Prosperity) proudly salutes the commitment of servicemembers, veterans, and military families who have supported and defended our nation. With many veterans in need of housing within the communities we serve, on Veterans Day 2014, Prosperity began extending incentive offers—in addition to the advantages…

Read more

Home Mortgage loan Information

Borrower Account Information Plaza Home Mortgage, Inc. ( Plaza ) is a licensed mortgage lender. Plaza may elect to retain servicing of loans or transfer loans to a new servicer. This is not a reflection on our borrowers or their properties, and it does not affect the terms or conditions of any loan other than those directly related to the servicing of the loan. If the servicing…

Read more

Home Mortgage loan types

The borrower only pays the interest on the mortgage through monthly payments for a term that is fixed on an interest-only mortgage loan. The term is usually between 5 and 7 years. After the term is over, many refinance their homes, make a lump sum payment, or they begin paying off the principal of the loan. However, when paying the principal, payments significantly increase…

Read more

Excel USA

The day began with Kirkwood starting ninth on the grid for the Progression Race and needing to finish among the top six to move on. The 18-year-old from Jupiter, Fla., was in the lead before the end of the opening lap and was never challenged. He was in action again little more than an hour later for the Last Chance Race in which he lined up 31st and needed to finish among…

Read more

HSBC Australia Home loan

How much can I borrow? As a general rule your income needs to be enough to afford the mortgage repayments. The amount you can borrow is also influenced by your track record at saving. Take into account any current borrowings and if you are managing the payments. If you are buying a house with a partner, then include his/her numbers as you calculate. Get in touch Want to talk…

Read more

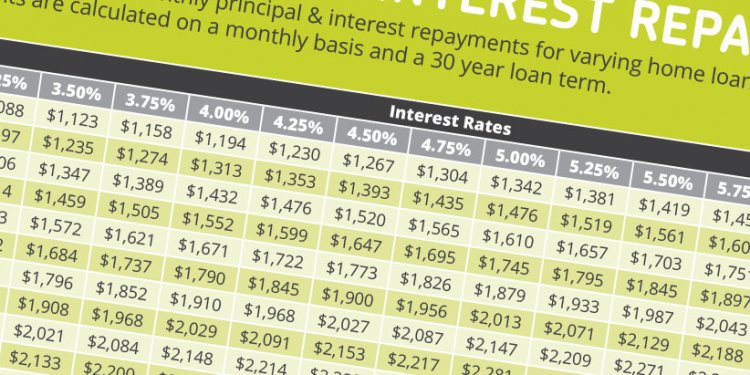

30-Year

The IETF turns 30! As we work on the day-to-day tasks needed to make the Internet work better, or even as we look back over last year and gaze ahead to the year to come, from time-to-time it is useful to consider our work on timescales that are a bit larger. This week marks the 30th anniversary of the meeting that became the very first edition of IETF meetings now held three…

Read more

HSBC Home Loans

How do I pay less stamp duty? It depends on what you are buying and where. Most states have first home buyer concessions (NSW, Vic, Qld, SA, WA, ACT, NT). Some states don t give concessions on established homes (NSW, for example). Land purchases are excluded in some states, for example Vic. Get in touch Want to talk later? Fill in our short online enquiry form and one of our…

Read more

Home Loans Alaska

One of the most daunting aspects of applying for a home mortgage is determining which types of loans you might qualify for, any distinct requirements they might have, and how much of a down payment is necessary for each. Luckily, First National Bank Alaska Home Loan Specialists provide local service and are committed to learning about your unique needs and finding your personalized…

Read more

Government Home Loans for bad credit

So the title of this story makes it pretty clear what we’re diving into today. or home loans for poor credit. As Americans we should all have a better understanding of where we are in our quest for the American Dream. Whether you’ve already owned a home for years or you’re getting ready to buy your first, this will hopefully help ease your fears (and relieve some stress) about…

Read more

Mortgage for foreigners

There are two types of mortgages for foreigners, for non residents and for foreign residents. Mortgages for non residents are a type of mortgage which are granted by financial institutions in Spain to foreigners, or Spaniards whose tax residence is outside of the country. Moreover, the economic documentation requested for non resident citizens is usually specific to their country…

Read more

Federal Mortgage Relief

Fixed Rate Mortgage Predicable payments: The interest rate and principal and interest (P&I) payment remains the same for life of the loan. Various loan term options available up to a 30-year term. No Mortgage Insurance option available on a 20-year or less term. Bi-weekly payment option available. On a shorter term loan, the monthly P&I payment is typically…

Read more

Common loan

Mistake #1: Letting your contact information become out-of-date Moving away from campus? Changing your cell phone number or e-mail address? Make sure you let your loan servicer know. Their services are provided free of charge , but they can only help you if they can reach you. Mistake #2: Paying for student loan help You may have seen an ad on Facebook, or gotten phone calls…

Read more

Information about Home Loans

The state of has a rich military history dating back to the Revolutionary War and has given birth to such military leaders as Gen. Douglas MacArthur. Situated between the Ozark Mountains and the Mississippi river, the state is known as The Natural State and offers a wide variety in terrain and geography to homeowners, tourists and outdoors enthusiasts. Granted statehood in…

Read more

Personal Home Loans

If you are shopping for a loan, ask yourself these questions to help you find the right loan: What do I hope to accomplish? If you want to consolidate or refinance existing debt, for example, then it is important that your new loan is at a lower interest rate than your current loan(s) so you save money in the long run. If you are shopping for a new loan, you will want to make…

Read more

Government Employees Home Loans

State Bank of India has announced cheaper home loan schemes for defence personnel and Central government employees, keeping in mind their enhanced capacity to repay after the recent salary hike accepted by the NDA government. In Picture: Auto rickshaws wait in front of the head office of State Bank of India (SBI) in New Delhi August 12, 2013 (Representational image)Reuters…

Read more