Government Mortgage Help

Help to Buy a home

Homeownership is still possible with poor credit. Bad credit does not automatically preclude you from obtaining a home loan. Also, bad credit does not automatically require you to pay a significant down payment up front in order to buy a home. Although credit availability and underwriting standards for most lenders are strict, there are options available to those who experienced…

Read more

Best Variable mortgage rates

Even though the Federal Reserve raised interest rates last December, mortgage rates remain low by historical standards. That’s good news if you plan to buy a home or refinance anytime soon. And because interest rates on mortgages are so favorable, most homebuyers naturally consider a traditional 30-year home loan. As attractive as that fixed-rate mortgage may be, you can likely…

Read more

Alaska Loan

AHFC provides renovation options covering three possible scenarios: Purchase Renovation Renovations in conjunction with a purchase Second for Renovation Improvements to a home you already own Up to $100, w/alternative evaluation Up to $312, 750 w/appraisal Refinance Renovation Incorporates renovations into a new loan. Who is Eligible? Alaska residents Eligible Properties Owner-occupied…

Read more

Government help with mortgage deposit

Nobody wants to return to the kind of risky home loans that spurred 2008’s banking collapse. Sliding back toward lax lending would be nuts. Yet Washington officially endorsed such loans this month. Federally controlled mortgage giants Fannie Mae and Freddie Mac announced they’ll back loans to low-income Americans who put just 3% down, even though such loans have a high default…

Read more

New mortgage Products

No Down Payment Mortgage A no down payment mortgage allows first-time home buyers and repeat home buyers to purchase property with no monies required at closing. Other options, including the FHA loan, the HomeReady™ mortgage and the Conventional 97 loan offer low down payment options with a little as 3% down. Mortgage insurance premiums typically accompany low and no down payment…

Read more

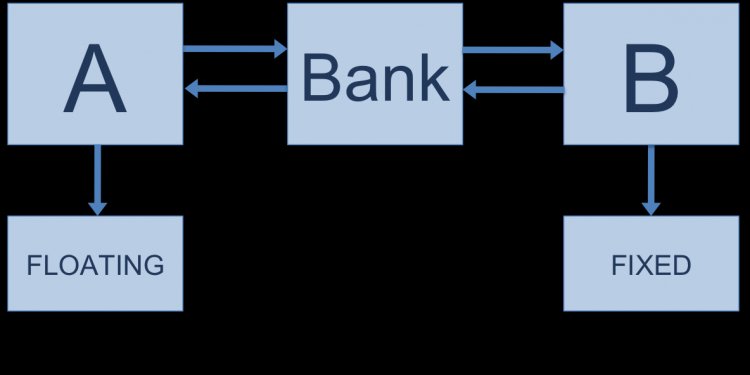

Fixed Interest Rate

There is no right answer to this question—it depends on your personal budget, your term, and your tolerance for risk when rates change. The most simplified way to think about it is this: variable loans can be cheaper—but your minimum payment will change over time—while fixed loans generally cost a little more and your minimum payment will never change. Variable rates are better…

Read more

Federal mortgage help

Correcting a comment from J.P. Morgan spokesman in the 10th paragraph SIGTARP Mortgage servicers reject 72% of struggling borrowers from a federal program aimed at creating more affordable monthly mortgage payments. WASHINGTON (MarketWatch) — Mortgage servicers reject 72% of struggling borrowers from a federal program aimed at creating more affordable monthly mortgage payments…

Read more

Need help Paying mortgage

Few people know about down payment assistance programs. When talking to potential homebuyers, one issue that is consistently brought up is lack of savings to pay for down payment. First, there is the misconception out there that you need 20% down payment to purchase a home. Is it great to have 20% and avoid paying private mortgage insurance (PMI)? Yes, of course. Is it necessary?…

Read more

Base rate HSBC

Latest BLR / BFR HSBC Bank 6.60% Effective from 28th July 2016 Latest Base Rate HSBC Bank 3.50% HSBC s presence in Malaysia dates back to 1884 when the Hongkong and Shanghai Banking Corporation Limited established its first office in the country, on the island of Penang, with privileges to issue currency notes. By 1959, The Hongkong and Shanghai Banking Corporation Limited…

Read more

Need help with mortgage payment

Do not procrastinate if you need help making your mortgage payments. The federal government has created several programs to help struggling homeowners stay in their homes. The government designed these programs to help everyone who needs it. Some programs are for people who have made all of their payments but the value of the home is less than their loan. Others are for people…

Read more

Lowest 30 year fixed mortgage

Daniel Acker | Bloomberg | Getty Images Mortgage rates haven t moved much this year, and the good news is they ve been stuck at historically low levels. But the bad news is that may be about to change. Both home prices and mortgage rates are expected to move higher as we head through the fall, and that makes shopping for the right mortgage all the more critical. While various…

Read more

Government help on mortgage

With interest rates low (though rising), more credit available to qualified borrowers, and employment up, it s a good time to buy a home if you are financially ready and able. But many potential homebuyers see the down payment as a hurdle too high to jump. It might be lower than they think, however, and they might be eligible for a financial boost. The Down Payment Doesn t…

Read more

Help Paying mortgage

We get dozens of requests at GetRichSlowly.org every day. They are usually queries such as “Can I guest post to promote my business?” (No.) “Will you share our infographic with your readers?” (No.) Last week we received one that intrigued me. The writer had started a crowd-funding effort to pay off his mortgage and he wanted me to share it with the Get Rich Slowly community…

Read more

Lomas mortgage USA

VP Danny Gardner Danny Gardner has been vice president of Single-Family Affordable Lending and Access to Credit since March 2015. He came to this role with more than 20 years experience in the mortgage industry, mainly promoting opportunities for first-time homeownership. Before joining Freddie Mac, Gardner was vice president of Community Reinvestment Act (CRA) Lending at…

Read more

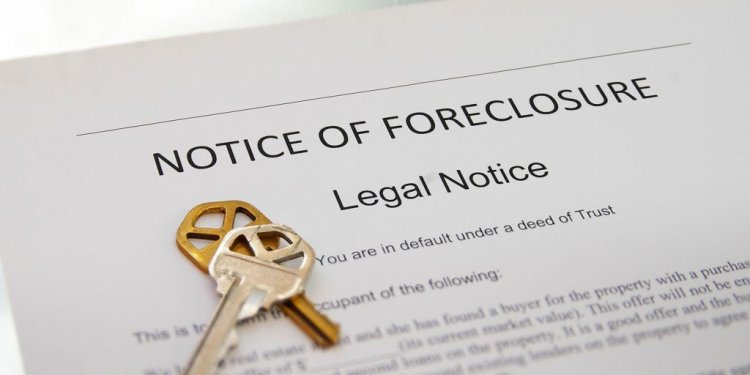

Government mortgage help Programs

The government s Home Affordable Modification Program can save homeowners money each month. The number of U.S. foreclosure filings hit a record 2.8 million in 2009, according to RealtyTrac. Fortunately several programs offered through the federal government have been created to help homeowners who are struggling to pay their mortgage loans each month. By working with these…

Read more

Help for mortgage payments

Lenders can initiate the foreclosure process after a single missed payment. Foreclosure is devastating and affects the entire community. Charities and non-profit organizations throughout the country help homeowners avoid foreclosure by offering financial assistance. The eligibility criteria to receive help varies among charities and locations. There are several national charitable…

Read more

Acquisition mortgage

Through the efforts of Habitat for Humanity, more families are realizing their dreams of a better life through home ownership. However, many Habitat for Humanity affiliates have already deployed the majority of their capital in building, repairing, and financing the purchase of homes. These funds will be repaid over several years through mortgage payments from borrowers, but…

Read more

FHA loans gov

FHA Home Loans FHA Home Loans are mortgages insured by the Federal Housing Administration that feature lower underwriting standards and rates than conventional loans, along with lower minimum down payments of 3.5%. Additionally FHA borrowers are required to pay for mortgage insurance (MIP) to protect the lender in the event of a default. FHA Loans Are Flexible And Accessible…

Read more