Best fixed rate mortgages 5 years

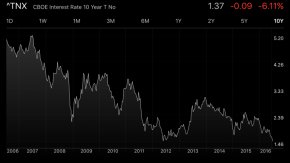

From this simple chart, you will understand:

From this simple chart, you will understand:

* The risk free rate of return

* Expectations on interest rates

* Expectations on inflation

* Borrowing/credit costs

* Risk aversion, or lack thereof

* The health of the world

That’s right. By understanding what the latest 10-year treasury means, you will be able to save a lot of money, make a lot of money, and stop being an bozo who just follows the heard and listens to whatever people tell you to do. Think for yourself!

I’m dismayed how people are paying more in mortgage interest than they have to. A large part of it is because the media and mortgage officers continue to push people to get as long a fixed rate mortgage as possible. In America, the longest conforming standard is 30 years.

Borrowing on the long end is a suboptimal use of funds. The people who are pushing you into 30-year fixed loans: 1) Are not economics majors or bond traders, but journalists, and/or 2) Have a vested interest in you borrowing as long as possible so they can make as much money off you as possible. The higher the rate, the easier it is for them to earn a wider spread.

WHY 30 YEAR FIXED MORTGAGE LOANS ARE A WASTE OF MONEY

Shop around for a mortgage: Mortgage rates have collapsed after Brexit, and US assets are aggressively being bought by foreigners due to our stability. Check the latest mortgage rates online through LendingTree. They’ve got one of the largest networks of lenders that compete for your business. Your goal should be to get as many written offers as possible and then use the offers as leverage to get the lowest interest rate possible. This is exactly what I did to lock in a 2.375% 5/1 ARM for my latest refinance. For those looking to purchase property, the same thing is in order. If you’ve found a good deal, can afford the payments, and plan to own the property for 10+ years, I’d get neutral inflation and take advantage of the low rates.

* Upward sloping yield curve. It’s important to understand that due to the time value of money and inflation, the longer you borrow the higher your interest rate. If you borrow money from me today to pay me back tomorrow, I won’t charge you interest. But, if you want to borrow money from me today, to pay back over the next 30 years, you better hell believe I’m going to charge you an interest rate above inflation to counteract inflation, make some money, and bake in some risk of default.