Housing Loan

Lowest Housing loan Interest Rates

Get The Lowest VA Home Loan Interest Rate VA Home Loan Centers will compare rates from all approved lenders and find you the lowest rate available. How Is The VA Home Loan Interest Rate Calculated? Each lender and bank will set their own rate. Because of this, it is important to check the VA home loan rates offered by all banks and lenders. Your lender will usually only quote…

Read more

Loan Process Steps

Here is the sequence of steps in the home loan process. Complete the application Your lender will assist you to fill out a loan application. (The next screen provides more information.) Get preapproved After reviewing your completed loan application, the lender can give you a preapproval letter, a written letter that confirms the price of home you can purchase. Processing Your…

Read more

USAA Mortgage bad credit

FICO score, VantageScore, BlahBlahBlah score. But did you know there are some surefire moves to getting a good score or improving one regardless of the scoring model being used? Four ways to build a better credit score: Be in the game. To improve your credit score, first you must actually have credit. This typically starts with getting a credit card or a loan from an institution…

Read more

Housing Mortgage loan

2 Are You Selling? If you are selling your home and bought it with either a SoftSecond or ONE Mortgage loan, these are the steps you need to take to satisfy your loan requirements. SoftSecond Loan Program: If you bought your home with a SoftSecond loan, your first and second mortgages are owned by your lender. Only your lender can provide payoff information for your first and…

Read more

Home loans types

Veterans who possess an adjustable rate mortgage (ARM) and owe more than they can afford have options. A VA Refinance Loan can enable homeowners the ability to capitalize on lower rates, as well as getting cash back and using the money in a variety of ways. While not being able to make the current payment is a great reason to refinance, it is hardly the only reason. According…

Read more

Reverse Mortgages Colorado

Reserve mortgages are often used by older homeowners considering using the equity in their home as an alternative financial asset management tool to provide funding for certain activities. As with any financial management tool, homeowners should first fully take the time to understand reverse mortgages, know who they are conducting business with, and make completely informed…

Read more

HSBC new Mortgage Rates

Healthy new beginnings – the twelfth in the Future of Retirement series – shows that for working age people, putting money aside for a comfortable and healthy retirement is not always easy. Health is a priority for both retirees and those looking ahead to retirement. The way you spend your retirement depends on both your physical and financial health, now and in the future…

Read more

Mortgage loans for federal employees

Mortgages Officers Whether you are looking for someone to assist and educate you throughout the mortgage process, or maybe you prefer to apply online or by telephone, our professional representatives are here to accommodate your preference and meet your needs. You can be assured of the advice you receive, as none of the MEFCU representatives work on commission. Pat Stewart…

Read more

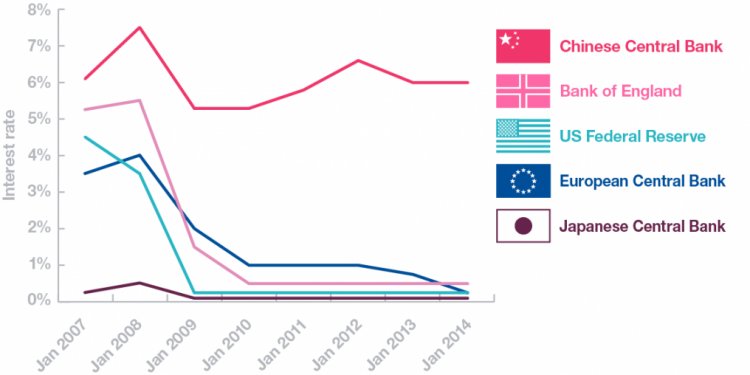

Best variable rate Mortgage

By Lisa Smith A variable-rate mortgage, also commonly referred to as an adjustable-rate mortgage or a floating-rate mortgage, is a loan in which the rate of interest is subject to change. When such a change occurs, the monthly payment is adjusted to reflect the new interest rate. Over long periods of time, interest rates generally increase. An increase in interest rates will…

Read more

Non-Resident Mortgages

This calculator is designed to work out if you are eligible for an Australian mortgage to purchase or refinance real estate in Australia. It will check your situation against the policy of four major Australian lenders that we commonly recommend for non-resident loans. Reduce your loan amount: If all of the lenders are giving a “declined” result then it may be because you are…

Read more

Types of Housing loans

Have you just purchased a home or commercial office and are wondering what type of mortgage financing plans are available? Let s take a look more in details of the various types of mortgage loans available in Singapore: 1. Fixed Rate Mortgages Your home loan plan is fixed for a certain period of time, from 1-5 years. Current financing interest rates packages hover between 1…

Read more

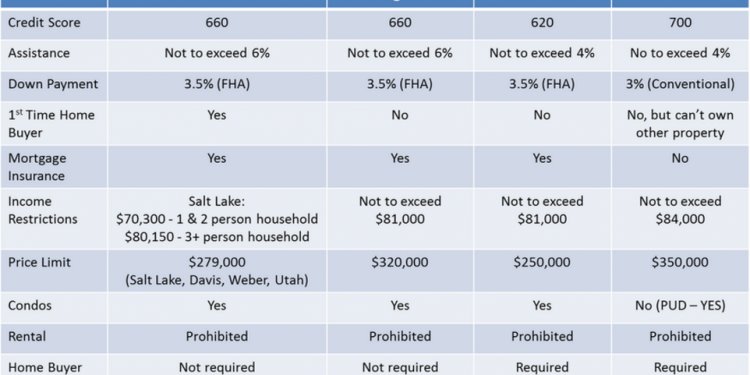

Government Housing loans bad credit

Because of changes in legislation, lending requirements and related issues, FHA regulations and underwriting requirements are subject to change from time to time. Some of the changes come as part of new laws that close legal loopholes, improve the fairness of the FHA mortgage loan process, or modernize the FHA loan program. Other alterations are made in response to current…

Read more

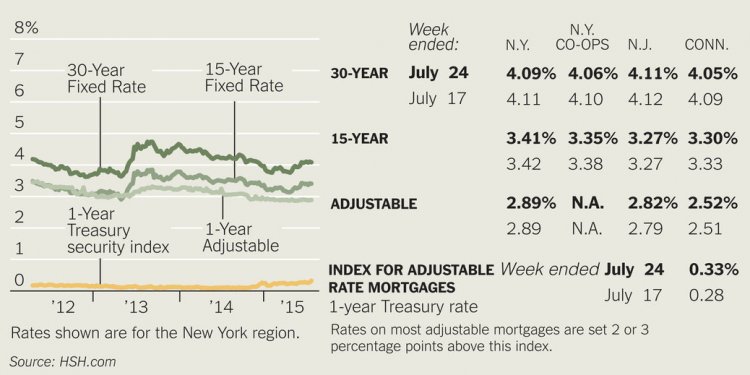

10 Year Refinance Rates

The Federal Reserve decided to leave short-term interest rates unchanged when it met in April but left open the possibility of raising rates in mid-June. News of the Fed’s decisions is always of interest to homeowners and prospective homeowners, because short-term rates have an effect (though not a direct one) on the long-term interest rates that mortgage lenders charge. Mike…

Read more

Mortgage 5

Mortgage applications increase, driven by refinance activity Eager to take advantage of low mortgage rates, existing homeowners helped boost mortgage applications by 2.9% from one week earlier, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending Sept. 30. Refinance applications increased 5% from the previous week…

Read more

New Mortgages

New rules went into effect for mortgage closings in 2015. The Consumer Financial Protection Bureau’s “Know Before You Owe” initiative aimed to simplify loan disclosures and help borrowers better understand their mortgage terms — and perhaps reduce last-minute loan closing drama. (“Wait, what? That was a teaser interest rate?”) TRID mortgage closing docs explained The TILA-RESPA…

Read more

Bank Rates.com Mortgage Rates

Rawpixel.com / Shutterstock.com Refinancing might be tricky for homeowners facing obstacles like sub-par credit, little equity in their homes, or worse yet, homes that are currently worth less than they’re mortgaged for. But thanks to the Federal Housing Administration, refinancing to potentially better FHA rates has become a reality for many homeowners. A refinance could help…

Read more

Housing loan Information

Based on VA guidelines, the VA limits their loan guarantees to a maximum of $417, unless it’s listed higher based on county limits. In the case of, (both city and County), that limit is $625, 500 for 2016, which reflects the significantly higher real estate prices that you’ll find in the city. That’s for a $0 down, VA home loan limit. San Francisco is the fourth most densely…

Read more

Federal Housing loans

Buying a new home should be a pleasant experience. At Yakima Federal Savings and Loan, we make it easier to buy or build your new home, or refinance your existing home. We’ve been lending money to local families for homes since 1905. The loans start here, and they stay here. When you are dealing with something as important as a loan to buy or build your new home, it’s nice…

Read more