Common loan

Mistake #1: Letting your contact information become out-of-date

Moving away from campus?

Changing your cell phone number or e-mail address?

Make sure you let your loan servicer know. Their services are provided free of charge, but they can only help you if they can reach you.

Mistake #2: Paying for student loan help

You may have seen an ad on Facebook, or gotten phone calls or letters from companies offering to help you lower your payment or apply for loan forgiveness for a fee. If someone asks you to pay for these services, you are not dealing with the U.S. Department of Education or our loan servicers.

We don’t charge application or maintenance fees. If you’re asked to pay, walk away (or hang up).

Contact your loan servicer for free student loan help.

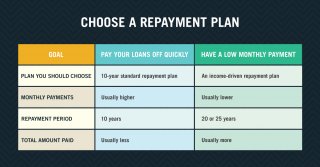

Mistake #3: Choosing the wrong repayment plan (or not choosing a repayment plan)

Your repayment plan determines your monthly student loan payment and how long it will take you to pay your loans back.

We offer several repayment plans, but your choice really comes down to what your goal is: to pay off your loan quickly or to have a low monthly payment. The 10-year standard plan will allow you to pay off your loan quickly and save you money in interest. An income-driven plan will allow you to have low monthly payments, but you will be in repayment for longer and pay more interest. If you take no action, you’ll automatically be placed on the 10-year plan.

The best way to compare your options is to use our repayment calculator.

TIP: Seeking Public Service Loan Forgiveness? You need to choose an income-driven repayment plan to benefit from the program.

Mistake #4: Not consolidating your loans when you should

Took out federal student loans before 2011?

Then you probably need to consolidate your loans for better repayment options, like Public Service Loan Forgiveness or the best income-driven repayment plans. Make sure you know the pros and cons of consolidation and contact us for help deciding.

Mistake #5: Not setting up automatic payments

Never miss a payment!

Sign up for automatic debit through your loan servicer, and monthly payments will automatically be made from your bank account.

And, you’ll get a 0.25% interest rate deduction when you enroll!

Mistake #6: Not paying extra (when you can)

Interest on your student loan accrues every day.

An easy way to save money is to pay extra whenever you can.

You can pay off your loan faster if you tell your servicer these two things:

You can pay off your loan faster if you tell your servicer these two things:

- The extra payments should not be put toward any future payments, and to

- Apply extra payments to the highest interest rate loan.

This will reduce the interest you pay, and over time, reduce the total cost of your loan.

Mistake #7: Paying late or missing payments

Late or missed payments hurt your credit score and will affect your future ability to get loans for things like a car or a home.

If you miss multiple payments and go into default, your wages could be garnished and your tax refund withheld.

If you’re overwhelmed or can’t afford your next payment, contact your loan servicer as soon as possible. They can recommend options to reduce or postpone your payment and keep your loan in good standing.

The worst thing you can do it to stop paying your loan.

Mistake #8: Postponing payments (without considering other options first)

There are two ways you can temporarily stop (postpone) your payments: through a deferment or forbearance.

They can be helpful solutions if you’re experiencing a temporary hardship, but they aren’t good long-term solutions because they don’t actually help you pay the loan back.

In most cases, interest on your loan continues to accrue (accumulate) even while you’re not making payments. Eventually, it may capitalize (interest accruing on interest). When you resume payments (which you‘ll have to do) your loan balance will be higher than before.

For example, you may want to consider an income-driven repayment plan instead. Under these plans, if you’re single and make less than $1, 486 per month, your monthly “payment” could be set at $0, which is technically what it would be with a deferment or forbearance. The benefit of choosing an income-driven plan over postponing payments is two-fold:

(1) Interest subsidies*, meaning if your payment doesn’t cover the interest that’s accruing on your loans, the government may cover some or all of that interest for you, and

(2) Loan forgiveness is built in to the plans, so even if you aren’t paying your loan back as quickly, there is light at the end of the tunnel.

* The government may pay the interest on certain types of loans if you choose a deferment.

If you ever need one-on-one help with your student loans, contact your loan servicer.

Your loan servicer works on behalf of the Department of Education to collect payments and answer questions about your student loans. Your loan servicer should be your go-to resource throughout the repayment process.

Their advice and assistance is always FREE! You never have to pay for help with your student loans.