Fixed Rate Mortgage

Best fixed rate mortgages 5 years

From this simple chart, you will understand: * The risk free rate of return * Expectations on interest rates * Expectations on inflation * Borrowing/credit costs * Risk aversion, or lack thereof * The health of the world That’s right. By understanding what the latest 10-year treasury means, you will be able to save a lot of money, make a lot of money, and stop being an bozo…

Read more

Best fixed mortgage Rates Today

One of the best ways to take advantage of low interest rates is to refinance your 30-year mortgage to a 15-year loan. While doing this might not lower your monthly payment, it will do something even better — get your house paid off more quickly, letting you end up with no payment at all in just fifteen years. How a 15 Year Fixed Mortgage Works 15 year mortgages work similarly…

Read more

Cheapest mortgage Rates UK

Getty Mortgages are cheaper than ever, is it time you cashed in too? Re-mortgage lending lifted to its strongest levels in seven years in July as home owners snapped up the cheap deals available, banks and building societies have reported. But elsewhere there were signs of the market cooling, and the Council of Mortgage Lenders, which released the figures, said it is too early…

Read more

30 Year Mortgage Rates Bankrate

Home-shoppers, be cheerful: Job growth in June was surprisingly high, but the news hasn t had much effect on mortgage rates. They re staying near record lows. Today s report said that employment increased in June by 287, . That s 107, more jobs than the consensus forecast. Treasury yields barely reacted to the news, creeping up to 1.41% from yesterday s 1.39% as I write this…

Read more

Compare 30 Year mortgage Rates

By · Bankrate.com Riley Arthur/Bankrate Wells Fargo s rates are staying competitive on mortgages, auto loans and credit cards. Overall, rates on loans are historically low. Those seeking a loan will find it s a good time to be in the market. Wells Fargo mortgage rates The rate on a 30-year fixed-rate loan from Wells Fargo is 3.625%, around a fifth of a basis point higher than…

Read more

Compare 15 Year fixed mortgage Rates

Adjustable-rate loans, particularly 5/1 ARMs, are showing the most movement Monday in a survey of mortgage rates offered by national lenders, according to NerdWallet. Thirty-year fixed-rate mortgage rates are unchanged, while 15-year loans are priced slightly higher today. The NerdWallet Mortgage Rate Index compiles annual percentage rates — lender interest rates plus fees…

Read more

Best 30 Year fixed mortgage Rates Today

“As there are no major economic reports coming out today, I do not expect a worsening of interest rates, ” Hillary Legrain, vice president at First Savings Mortgage in Bethesda, Maryland, tells NerdWallet. Most observers believe the Fed will pass on a rate hike yet again, due to last Friday’s disappointing employment report. Meanwhile, more than one major lender repriced 30-year…

Read more

30 Year fixed mortgage Rates Today

By · Bankrate.com Several benchmark mortgage rates were higher today. The average rates on 30-year fixed and 15-year fixed mortgages both floated higher. The average rate on 5/1 ARMs, the most popular type of variable rate mortgage, also inched up. Rates for mortgages are in a constant state of flux, but they remain much lower overall than they were before the Great Recession…

Read more

Mortgage Acquisition

IMAGE: Fotolia Ellie Mae hasn t been pleased with the customer-relationship management vendor it acquired in early 2014. Those disappointing results, along with the desire to offer clients more robust capabilities, prompted the mortgage software provider to acquire another CRM vendor, Mortgage Returns. Acquiring the St. Louis-based vendor and its approximately 220 lender clients…

Read more

5 years mortgage fixed rate

This calculator helps you compare a fixed rate mortgage with both fully-amortizing and interest-only adjustable rate mortgages (ARMs). With mortgage rates near their historic lows, fixed rate home mortgages are likely going to be a much better deal if you plan on living in the house for an extended period of time, as when rates reset on ARM loans the prior short-term savings…

Read more

Lowest five Year fixed rate mortgage

Great news for Canadian home buyers: you now have access to a 2.44 per cent mortgage rate, the lowest five-year fixed pricing in history. This rate is currently offered by Spin Mortgage in British Columbia, Alberta, and Ontario. Nation-wide, competition is down to a hair, with other small lenders and brokers offering between 2.48 – 2.50 per cent for the term. 2015 is shaping…

Read more

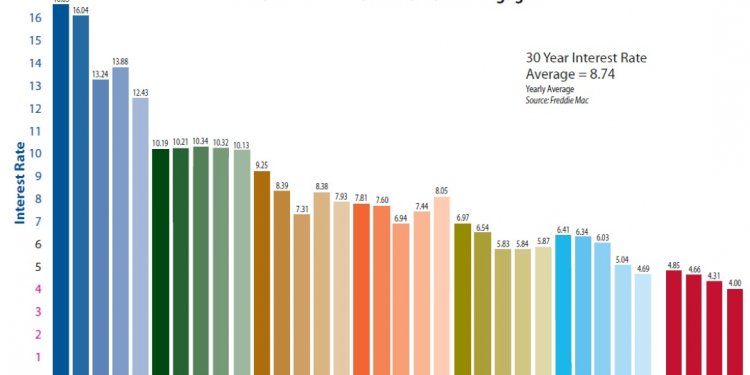

20 Year fixed Rates

So you wanna refinance or lock in to a new mortgage rate, eh? Mortgage rates have never been lower in the history of the modern mortgage. They could’ve been lower in the Stone Age, or maybe even the ice age, but not in the modern age. While rates can fluctuate on a weekly basis, one thing is constant – rates are hovering around all-time lows, and you should take advantage of…

Read more

Fixed mortgage Rates UK

Thirty-year fixed rates approached all-time record lows in the wake of the vote. Will they continue to drop? Financial market turmoil can be good for mortgage rates. Don’t forget this concept as you continue to read headlines about how a “Brexit” is wreaking havoc on markets. Brexit is slang for Britain’s vote Thursday, June 23 to exit the European Union (EU), which is a political…

Read more

Best 5 years fixed rate mortgages

Mongoose vs. Cobra. Coyote vs. Roadrunner. Pirate vs. Ninja? And finally, fixed-rate mortgage vs. adjustable-rate mortgage. Yes, we’re talking about the greatest rivalries of all time. So what’s better, the boring old fixed-rate mortgage or the more provocative adjustable-rate mortgage (ARM)? During the housing boom, homeowners often chose adjustable-rate mortgages as a means…

Read more

HSBC fixed rate mortgage 5 years

HSBC s lowest-ever rate mortgage is a good deal, if you don t mind not having the security of fixed-rate. Photograph: John Stillwell/PA The mortgage price war is heating up as lenders try to win your business, and now HSBC has launched a home loan with an interest rate of just 0.99%. It’s the lowest the bank has ever offered, and the lowest currently advertised by a lender…

Read more

Best residential mortgage Rates

Mortgage rates in Massachusetts tend to be lower than the average national mortgage rates. However, the median home price in the state generally exceeds the cost of a home nationwide. Higher demand and higher wages in the state act to push home prices higher than in many other states. Popular Cities to Live in Massachusetts The ten largest cities in the state are Boston, Worcester…

Read more

15 Year fixed mortgage Rates history

The 15-year fixed rate fell to 2.56% from 2.61%. A year ago, it stood at 3.07. The most popular mortgage, the 30-year fixed rate, came in at 3.35%, a drop of 0.05 percentage point and only 0.04 percentage point above its record low set the week of November 21, 2012. The rates provide a welcome boost to the housing market and to the overall economy, according to Frank Nothaft…

Read more

HSBC 2 Year fixed rate mortgage

Made to measure: mortgage lenders can offer bespoke deals with rates dependent on the applicant s history, circumstances, account use and more. Photograph: Lal/Getty The best things in life come to those who ask for them. At least, that s the message some of the UK s biggest banks are sending out to mortgage borrowers. Guardian Money has found that several banks and building…

Read more