Home Loan Rates

International mortgage Plans

The news comes weeks after the bank quietly discontinued offering international mortgages to expats in other markets, and four years after it was bailed out by the UK government, leaving it 41% owned by UK taxpayers. A spokeswoman for the banking group stressed that the suspension of both the UK and overseas international mortgage services was taking place while a review of…

Read more

First Reverse mortgage

Use the Equity You ve Built in Your Home To Pay You Wondering how you will get the money you need to pay for rising healthcare costs, monthly expenses, taxes and home improvements? You may be overlooking one of your biggest assets-your home. If you are a homeowner age 62 or older, an OceanFirst reverse mortgage enables you to take the equity you have built in your home and…

Read more

Home loan rates fixed

You can take 2 fixed-rate advances per year and can have up to 3 at any given time. The minimum amount for an advance is $10, . Let s say you have a $50, line of credit and you want to take a fixed-rate advance of $25, to pay for a kitchen remodel. The terms of your advance will determine your monthly payments, but you can be sure they won t change during that set period…

Read more

Special Mortgages

Not Everyone Has Money For Downpayment Home buyers don t always come with high credit scores and a large downpayment. Rather, many have just average credit and very little savings at all. In today s housing economy, though, both groups can apply for a mortgage and get approved at great rates. Buyers with excellent credit and a sizable down payment may be drawn to the conventional…

Read more

Home loan interest rates of all banks

NEW DELHI: Home loan borrowers cheered on 29 September as the RBI slashed its lending rate by 50 basis points (bps). An immediate fall in interest rates as banks passed on the benefit to borrowers was what they were looking forward to. However, the latest rate cut meant RBI has lowered its policy rate by 125 bps since the beginning of this fiscal. In contrast, banks have reduced…

Read more

20 Year interest rate

Early in my career, I was indoctrinated with a very powerful phrase “the stock market has averaged 12% over its history.” That phrase stuck in my head, and even made its way to my mouth very early in my career. But is it true? And if it is true, does that mean that people can expect to earn 12% per year on their investments? The answer is that 12% is a ridiculous number. But…

Read more

International Property Loans

Before buying property overseas, it pays to familiarize oneself with international mortgage products, the options available and the processes involved. Mortgage Characteristics Mortgage products themselves are standard in all countries,says Sergei Millian, CEO of Millian Group Inc., an Atlanta-based international real estate services firm with offices in Azerbaijan, Belarus…

Read more

Lowest interest rates for home Loans

If you have too much debt to qualify for a conventional mortgage, less than stellar credit scores or not much cash for a down payment, consider buying a home with an FHA loan. The Federal Housing Administration, a division of the Department of Housing and Urban Development, was created 80 years ago to help low- and moderate-income families borrow the money they need to buy…

Read more

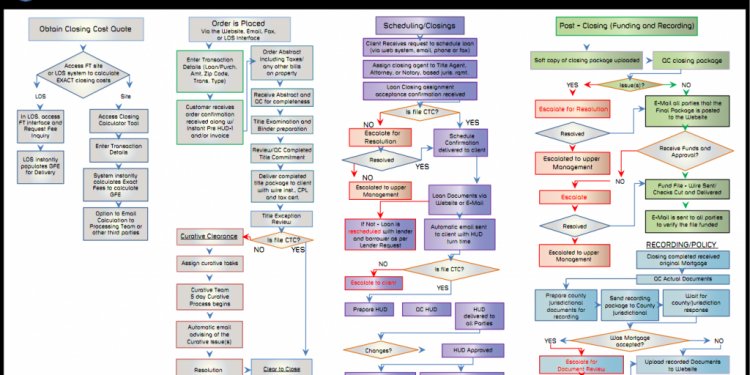

Mortgage process in us

By Lisa Smith A home of your own. That little phrase captures so much emotion, and so many hopes and dreams. It s a place to express yourself and somewhere you can do what you want to do when you want to do it. You can decorate, landscape and shape your surroundings with no limits other than your imagination and your budget. Quite simply, for many people, homeownership represents…

Read more

Low home loan rates

They did it again. Mortgage rates dipped for the sixth week in a row — just above the 2015 low of 3.59% — thanks to a still-volatile stock market. Meanwhile, a lack of housing inventory is putting the squeeze on potential homeowners who risk being sidelined by increasing home prices and too few homes to choose from. Freddie Mac’s just-released weekly survey of lenders shows…

Read more

Conforming loan rates

2015 Loan Limits: 10th Year At $417, Leaving mortgage loan limits unchanged helps existing U.S. homeowners to refinance; and gives today s home buyers access to government-backed home loans with low mortgage rates. Effective from January 1, 2015, this year s loan limits apply to conventional mortgages nationwide, including purchase loans and refinance transactions. FHA loan…

Read more

Compare fixed rate home Loans

With a fixed rate mortgage, a loan s note rate remains constant throughout the life of the mortgage. This consistency gives borrowers peace of mind knowing that the principal and interest portion of their mortgage payment will not change over time. While the total principal and interest payment does not vary, the amount applied to each portion will change over time. During…

Read more

Real Estate Mortgages

It’s important to think carefully beforehand about how you are going to finance your property in Mexico. This guide gives an overview of financing options available in Mexico for property buyers. A realty agent in Mexico may be able to advise you, and some even have connections with financial institutions (banks, mortgage brokers) who may proffer financial solutions, depending…

Read more

Home loan interest rates lowest

Mortgage Closing Costs Are Rising Closing costs are rising. New loan regulations and financial safeguards have increased to bank costs, and banks have passed those costs on to consumers. Bankrate.com says mortgage closing costs are 6% higher as compared to last year. There are ways to limit what your closing costs, though, and what you ll pay for your loan. Want to have the…

Read more

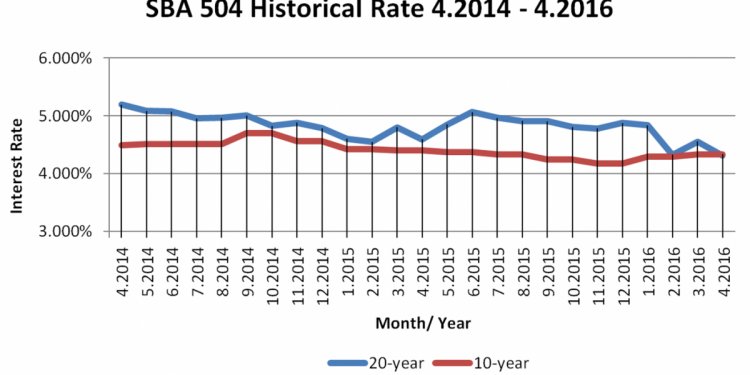

10 Year Loans

Last month I had the pleasure of seeing Sarah Bauder present at the COHEAO Annual Conference in Pentagon City, VA. Sarah is Assistant Vice President for Enrollment Services and Financial Aid at the University of Maryland, College Park (which happens to be my alma mater - Go Terps!). Her presentation detailed the results of a comprehensive study on 10 years of student loan defaulters…

Read more

Interest rates home loan

Home loan borrowers can expect to see a decline in their monthly EMIs after three of the country’s biggest lenders slashed interest rates aggressively last week. While SBI set the ball rolling by reducing rates on housing loans by 15 bps to the lowest in six years, private sector lenders ICICI Bank and HDFC joined the bandwagon with similar cuts. SBI continues to offer the…

Read more

20 Year home loan rates

Home > Programs > Fixed Rate > 20 Year Mortgage 20 year home loans can be the perfect product for consumers not wishing to stretch their mortgages all the way out to 30 years and who are not 100% sure that they can afford the payments of a 15 year or 10 year mortgage. Most 20 year mortgages do not have pre-payment penalties meaning you could essentially…

Read more

Mortgage rates us

Will Yellen surprise us at Jackson Hole? By · Bankrate.com Federal Reserve Chair Janet Yellen returns to the most-watched economic confab of the year - the symposium in Jackson Hole, Wyoming - after missing last year s meeting, and all ears will be listening for any hint of changes in monetary policy for the rest of the year. The topic of the Aug. 25-27 conference is Designing…

Read more