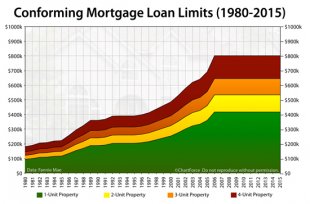

Conforming loan rates

2015 Loan Limits: 10th Year At $417, 000

Leaving mortgage loan limits unchanged helps existing U.S. homeowners to refinance; and gives today's home buyers access to government-backed home loans with low mortgage rates.

Effective from January 1, 2015, this year's loan limits apply to conventional mortgages nationwide, including purchase loans and refinance transactions. FHA loan limits and VA loan limits may be different, by county.

What Is A Mortgage Loan Limit?

Loan limits are appropriately named. They are the maximum allowable loan size for a mortgage. Loan limits vary by product and region, and specified within a loan program's given mortgage guidelines.

For example, the Federal Housing Administration enforces specific loan limits for FHA loans; and the Department of Veterans Affairs maintains specific loan limits for VA loans.

Loans which exceed an FHA loan's local loan limit cannot be insured and loans exceeding a VA loans local limit cannot be guaranteed.

For conforming loans - loans backed by Fannie Mae or Freddie Mac - loan limits have been unchanged since 2006 when the government moved to raise the national limit to $417, 000.

Conforming loans which exceed a local loan limit are commonly known as "jumbo loans". Jumbo loans are typically not backed by Fannie Mae or Freddie Mac, and are offered by local and national banks.

Jumbo mortgage rates are sometimes higher and sometimes lower as compared to conforming ones. However, because jumbo loans are not government-backed, eligibility requirements are often more stringent.

There aren't many low-downpayment options in the jumbo mortgage market; and, income and credit score requirements are often higher for jumbo loans. This is why the decision to leave the 2015 conforming loan limits unchanged is an important one.

With conforming loan limits held at $417, 000 for at least one more year, homeowners using conventional programs to refinance - such as HARP - and buyers using Fannie Mae's 3% downpayment program to purchase can get access to the lowest mortgage rates possible at the largest loan size available.