Home loan interest rates of all banks

NEW DELHI: Home loan borrowers cheered on 29 September as the RBI slashed its lending rate by 50 basis points (bps). An immediate fall in interest rates as banks passed on the benefit to borrowers was what they were looking forward to. However, the latest rate cut meant RBI has lowered its policy rate by 125 bps since the beginning of this fiscal.

NEW DELHI: Home loan borrowers cheered on 29 September as the RBI slashed its lending rate by 50 basis points (bps). An immediate fall in interest rates as banks passed on the benefit to borrowers was what they were looking forward to. However, the latest rate cut meant RBI has lowered its policy rate by 125 bps since the beginning of this fiscal.

In contrast, banks have reduced their base rates by only 50-55 basis points so far. Given the inertia on the part of the banks, it makes sense for borrowers to take proactive steps and negotiate a better rate of interest for their housing loans.

What are your options

Gaurav Khurana, CEO of Dialabank. com, an aggregation site, feels repricing your housing loan is a good option because it not only gets you a lower rate of interest but also saves you the hassle of going through the documentation process all over again.

"Banks are actively repricing housing loans as otherwise customers will move to another bank. No bank wants to lose the asset on its book, " he says. As a home loan borrower, you can wait a few days to allow all banks to announce their new base rates. You can then start negotiating. Typically, banks reprice rates to what they would offer a new customer. There is no additional documentation required. Once the bank sets the new rate for your loan, it will send a communication indicating the same.

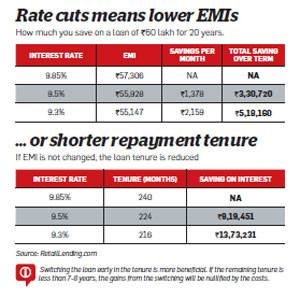

Let's assume you took a 20-year (240 months) home loan of Rs 60 lakh last month at 9.85%. If your bank resets the rate to 9.50%, your loan tenure will come down to 224 months. You will also save Rs 9.19 lakh towards interest repayment over the entire tenure. If you get a better deal still with some other bank, you should switch.

However, ensure you get at least a 15-20 bps point lower rate when you balance transfer your loan, says Sukanya Kumar, Director at RetailLending.com. Factor in the fact that you may need to pay a processing fee to the new lender, which could be negotiated and even be waived.

The fee can be 0.5-1% of the loan or a fixed fee of Rs 5, 000. Moreover, many banks may announce a rate cut only next month, which means beginning of the next quarter. This would mean the rate cut would be effective from the quarter after next or January 1.

For instance, for existing home loan customers of banks whose rate cut will be effective October 5, the benefit will kick in only from the month of November. Taking the example cited above, if you refinance your loan to 9.30% from 9.85%, your loan tenure will come down to 216 months or 18 years. You will also save Rs 13.73 lakh towards interest pay out over the loan tenure. However, if you are one of the few home loan customers who are repaying at 9.50%, you may want to wait and watch to know whether your lender cuts its base rate as well as the quantum of reduction. Similarly, new home and car loan borrowers, too, would do well to wait until all banks lay their cards on the table.

How do you go about it

You will need to submit a letter to the existing lender requesting a loan transfer. On receiving the same, the bank will give a consent letter or NOC and a statement mentioning the outstanding amount. You need to submit this document with the new lender, who then sanctions your loan to the old lender for an account closure.

Once the transaction is over, your property documents will be handed over to the new lender, and the remaining post-dated cheques or ECS will be cancelled. To transfer your housing loan, you will need your mortgage documents and foreclosure letter from the existing lender, and your loan repayment track record.

The bank you are shifting to will offer you a loan based on the current home loan rates it is offering to new applicants. "Till now, a cumulative reduction in repo rate has not been adequately transmitted via the banking system. The onus now shifts to the banking system and the government for flow of funds to the productive system of the economy, " says Arun Singh, Senior Economist at Dun & Bradstreet India.