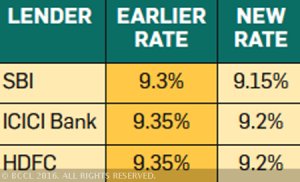

Interest rates home loan

While SBI set the ball rolling by reducing rates on housing loans by 15 bps to the lowest in six years, private sector lenders ICICI Bank and HDFC joined the bandwagon with similar cuts. SBI continues to offer the lowest interest rates under its recent offer of 9.15% for loans up to Rs 75 lakh sanctioned in November and December this year.

The private lenders now offer interest rates at 9.2% for home loans up to Rs 75 lakh, down from 9.35% earlier. For loans beyond Rs 75 lakh, the interest rate has been revised downwards to 9.25% for women borrowers and 9.3% for others. This offer is valid for all home loans taken upto 30 November. All three banks offer 5 bps lower interest rates to women borrowers.

For loans up to Rs 75 Lakh

Other lenders are expected to follow suit and slash their home loan rates. This may also be a good time for existing home loan borrowers to consider switching their mortgage to another lender. For instance, on a home loan of Rs 50 lakh, reduction in interest rate by 0.15% by SBI will help a home buyer to save Rs 542 per month and approximately Rs 2 lakh during the loan tenure of 30 years.

Value of the savings on EMI of Rs 542 per month, if invested in a recurring deposit, will be approximately Rs 6 lakh at the end of the loan tenure. Meanwhile, Indiabulls Housing Finance Limited (IBHFL), the second largest housing finance company in the country has revised its home loan rate to 9.15%, a reduction of 15 basis points, effective 4 November.

ICICI Bank has also launched a ‘Home overdraft facility’ for salaried borrowers, which offers dual advantage of a term loan as well as an overdraft facility. While the term loan provides money against property owned by the customer, the overdraft facility gives borrowers the flexibility to access funds instantly for meeting expenses. Those buying the overdraft loan from the bank would be able to utilise the funds for their personal needs. You can avail a minimum 10% of the total amount as term loan and maximum 90% as overdraft.