Home loan rates fixed

You can take 2 fixed-rate advances per year and can have up to 3 at any given time. The minimum amount for an advance is $10, 000.

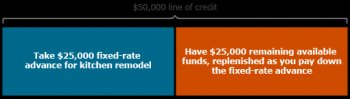

Let's say you have a $50, 000 line of credit and you want to take a fixed-rate advance of $25, 000 to pay for a kitchen remodel. The terms of your advance will determine your monthly payments, but you can be sure they won't change during that set period, even if the variable rate goes up. You'll still have access to the unused portion of your line of credit to help cover any other repairs or major expenses.

As you pay down the fixed-rate advances, your funds become available again.

Fixed-rate advances can be either fully amortizing or partially amortizing. Fully amortizing terms, which are typically longer terms, will repay your entire balance during the term. Partially amortizing terms, which are shorter terms, will have a remaining balance after the term that will revert back to the current variable rate.

Longer terms — 5 -20 years

- May have higher monthly payments.

- Will repay your entire balance during the FRA term.

- For longer terms that finish after draw period ends, FRA payments will continue until the balance is paid in full at the end of the term.

Shorter terms — 1-5 years

- May have lower monthly payments.

- Partially repays your balance during the FRA term.

- Shorter FRA terms must end at least 1 month before your end of draw.

You can make additional principal payments at any time without penalty. This may help you pay off your balance faster or decrease any unpaid balance. It also may result in less interest paid over time.