10 Year Loans

Last month I had the pleasure of seeing Sarah Bauder present at the COHEAO Annual Conference in Pentagon City, VA. Sarah is Assistant Vice President for Enrollment Services and Financial Aid at the University of Maryland, College Park (which happens to be my alma mater - Go Terps!). Her presentation detailed the results of a comprehensive study on 10 years of student loan defaulters. The purpose of the study was to identify the characteristics which are associated with defaults, as well as to establish a strategy on how and where to use financial literacy education as a proactive solution.

Last month I had the pleasure of seeing Sarah Bauder present at the COHEAO Annual Conference in Pentagon City, VA. Sarah is Assistant Vice President for Enrollment Services and Financial Aid at the University of Maryland, College Park (which happens to be my alma mater - Go Terps!). Her presentation detailed the results of a comprehensive study on 10 years of student loan defaulters. The purpose of the study was to identify the characteristics which are associated with defaults, as well as to establish a strategy on how and where to use financial literacy education as a proactive solution.

This graph shows the effect of UMCP's proactive solutions, as the University's default rate dropped substantially in 2009 when the national average rose 1.8%

Now, most of the time a presentation consists almost entirely of data, eyes will glaze over and iPhones will come to life. But during this presentation, all attendees were 100% engaged as the presentation was packed with alarming insights and astounding applications.

The study began with an extensive data warehouse project; data on academics, loan statistics, demographics and even campus activities were compiled for all student loan defaulters. Several trends emerged as certain characteristics continued to pop up for these former students.

Here are a few stats from the study:

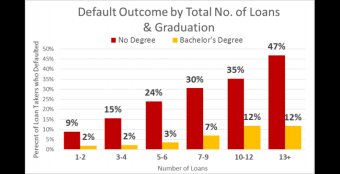

- Students that do not graduate had default rates more than 3.7 times higher than those that do graduate

- Independent students had default rates 2.3 times higher than dependent students

- Transfer students were more likely to default regardless of whether they graduate

- Almost one in five students with low high school GPA’s who did not graduate from college defaulted on their student loans

Unsurprisingly, the number one influencer was "not graduating". But more importantly, the data showed Bauder and her team which students were not graduating. The following factors were shown to be the biggest factors which increased the risk of default:

- Socio-economic barriers

- Independent filing status

- Students enrolled for 13terms

- “C” and below students

- Students with undeclared major

- Loans totaling over $20, 000; with more than 10 loans