20 Year interest rate

Early in my career, I was indoctrinated with a very powerful phrase “the stock market has averaged 12% over its history.” That phrase stuck in my head, and even made its way to my mouth very early in my career. But is it true? And if it is true, does that mean that people can expect to earn 12% per year on their investments? The answer is that 12% is a ridiculous number. But if 12% isn’t a reasonable rate of return on the money you invest, then what is? I think you will find that recent history (the last 25 years) has proven it’s much less than you think.

Early in my career, I was indoctrinated with a very powerful phrase “the stock market has averaged 12% over its history.” That phrase stuck in my head, and even made its way to my mouth very early in my career. But is it true? And if it is true, does that mean that people can expect to earn 12% per year on their investments? The answer is that 12% is a ridiculous number. But if 12% isn’t a reasonable rate of return on the money you invest, then what is? I think you will find that recent history (the last 25 years) has proven it’s much less than you think.

***Don’t be put off by all the charts and numbers in this post. This is a very easy concept to understand, and it’s very important that you understand it. If you don’t understand something that you see here, leave a comment in the comment section, and I will answer your questions.

First, I think we need some perspective. There are some things that you need to understand before my ultimate point will make any sense.

1. You need to know how/why an investment actually rises in value. When you see that your investment account went up over any period of time, it’s because one of three things happened. Those three things are: income was paid on the investment in the form of bond interest or a stock dividend, there was a realized gain (meaning investments were sold after they appreciated in value), or there was an unrealized gain (investments that you are still holding went up in value. In most instances, your investment account goes up because the investments within the account (stocks, mutual funds, bonds, etc) went up in value. This means that the demand for these exact securities was rising during the time frame. If your account went down in value, it’s most likely because the individual securities were deemed to be less in demand (based on perceived value). In reality, the only reason that your investments are worth anything at all is because someone else is willing to buy them from you.

2. Your goal is to keep pace with “the market.” This means that your long-term investment account should keep pace with what the standard stock market indexes do, in terms of performance. BTW, when people say the market, they usually mean the S&P 500 or the An index is selection of stocks that are used to gauge the health and performance of the overall stock market. For instance, the S&P 500 has 500 different stocks in it. If the market averages 4% over a tough 5 year period, then your investment account should do at least that well. If the market is up 24% over an awesome three year period, then your long-term investments should keep pace with this, assuming that you have at least a moderate risk tolerance. There are several reasons for this, but one of the primary reasons is cost. You may have heard in the past that you can actually invest in the indexes. This means you can buy something called an index fund, which recreates the stock portfolio of the actual index. These funds are usually dirt cheap. That means there aren’t many management fees involved. The more you pay in management fees, the less of your investment return you get to keep. Do you see where I’m going with this? If your investment account can’t keep pace with the index, and the index generally has lower management fees, then you should just own the index funds. If you are considering hiring a professional to manage your money, or even if you are just considering a standard mutual fund, make sure that there is a consistent long-term history of beating the market, net fees. The key in all of this is to beat the market without taking on unnecessary risks or fees.

If the market is up 24% over an awesome three year period, then your long-term investments should keep pace with this, assuming that you have at least a moderate risk tolerance. There are several reasons for this, but one of the primary reasons is cost. You may have heard in the past that you can actually invest in the indexes. This means you can buy something called an index fund, which recreates the stock portfolio of the actual index. These funds are usually dirt cheap. That means there aren’t many management fees involved. The more you pay in management fees, the less of your investment return you get to keep. Do you see where I’m going with this? If your investment account can’t keep pace with the index, and the index generally has lower management fees, then you should just own the index funds. If you are considering hiring a professional to manage your money, or even if you are just considering a standard mutual fund, make sure that there is a consistent long-term history of beating the market, net fees. The key in all of this is to beat the market without taking on unnecessary risks or fees.

The economy and the financial world have changed

We live in the modern economy. Our historical economy is nearly unrecognizable, in the world today. Technology has brought efficiency, and efficiency has transformed our old economy into what it is today. Our financial markets are completely unrecognizable. Nearly all investment transactions are made by supercomputers in nanoseconds. Speculators and day-traders have flooded the markets and tainted stock valuations. Apple is nearly a $500 billion company. Whatever the 1930’s equivalent of $500 billion was, Apple wouldn’t have been worth that in 1930. Apple, and its valuation, are the product of our modern (not necessarily better) economy.

This is to say that we shouldn’t rely on historical data to drive our investing decisions. The industry line that you hear most often is “past performance is not indicative of future performance.” That’s true. And if that’s true, then past performance from 1930 sure as hell shouldn’t affect your investment decisions 80 years later.

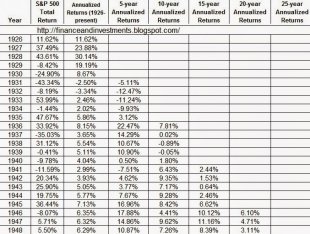

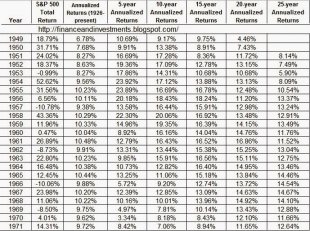

Let’s look at some data. Below you will see the entire historical returns of the S&P 500 from 1926 through 2014. What you will see is that the S&P 500’s historical average hasn’t been 12% since 1929. (The following charts are courtesy of FinanceAndInvestments.Blogspot.com). By the way, these are ridiculously awesome charts. I wish I had put them together.