Housing Loan

PAGE 2

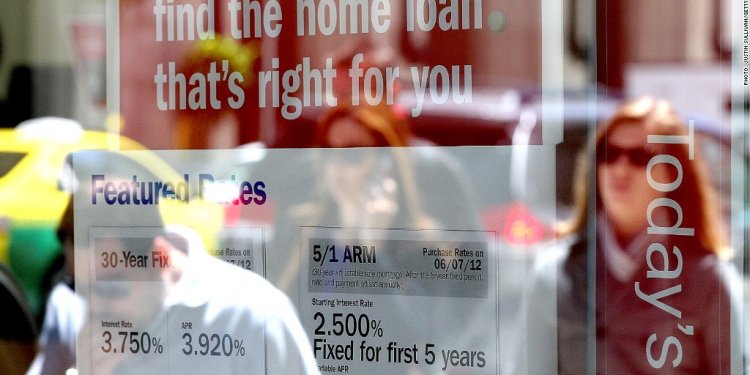

Mortgage Rates in the U.S

Patrick T. Fallon | Bloomberg | Getty Images A sign advertising home mortgage services at a Bank of America branch in Manhattan Beach, Calif. When it comes to rates and financial markets in general, things can always go either way, but I will say that the past two days are the scariest we ve seen since before Brexit,wrote Matthew Graham, chief operating officer of Mortgage…

Read more

HSBC Refinance Housing loan

One thing for sure, no one can predict what’s going to happen in the future. Having a home financing package that gives you the flexibility to adapt makes a big difference. Based on the principle of Diminishing Musharakah, HomeSmart-i gives you more control in your life and the flexibility to adapt to different priorities that may arise in the future. You call the shots Freedom…

Read more

Federal Mortgage

Low Rates. Local Service. Experience. Add it up and it s easy to see there is no comparison to the Best Mortgage Lender in Lafayette-West Lafayette as voted by Journal & Courier readers since 2009. Click here for a list of our employees registered through the Nationwide Mortgage Licensing System (NMLS) as of October 2016. Are you purchasing a home for the first time?…

Read more

Programs for Homeowners

Warning: Do not pay your next energy bill until you read this When homeowners check Home Solar Programs to see if they qualify, many are shocked to find out that subsidies and rebates can cover the upfront costs associated with installation, so you can literally get solar installed with no out of pocket expense. With little to $0 down, you could be on your way to significantly…

Read more

Mortgage Process step by step

Strongest Housing Market In A Decade So, as a first time home buyer, you want to enter this market with as much knowledge as possible. One of the best ways to understand the process of buying a home is to go through it step by step. The process will vary from one buyer to the next. It will also vary slightly based on the state in which you live. What follows is a guide to help…

Read more

Different Mortgage loan types

FHA and conventional mortgages are two distinctly different types of loans. Understanding the difference between FHA and conventional loans can help you avoid unnecessary time and expense when you try to qualify for a mortgage. FHA, or the Federal Housing Administration, insures or “backs” loans within certain parameters and through certain lenders. A conventional mortgage…

Read more

Different types of House loans

Mortgages and home equity loans are two different types of loans you can take out on your home. A first mortgage is the original loan that you take out to purchase your home. You may choose to take out a second mortgage in order to cover a part of buying your home or refinance to cash out some of the equity of your home. It is important to understand the differences between…

Read more

Mortgage Lenders Network USA

Study shows high-income minorities more likely to be sold subprime loans When you apply for a loan, whether it s to purchase a home or an automobile, the lender is going to make a determination about your creditworthiness. If they decide you have good credit, you ll get better terms and a competitive interest rate. If they decide you are not creditworthy, you are likely to…

Read more

Special Mortgage Programs

Homeownership these days is less on the radar of young people compared to previous generations, economic experts say. Mounting student loan debt has put homeownership largely out of reach for some, while others see a home as more of a burden than a badge of honor. Now one lender is trying to get many to reconsider. First Savings Mortgage Corp. in McLean has rolled out a program…

Read more

Mortgage 30 Year Fixed

Remember last year when the 15-year fixed-rate mortgage rate was an unbelievable bargain at just over 2.5 percent, the lowest in recorded history and about three-quarters of a percentage point below a 30-year fixed-rate loan? So everyone buying a house was getting a 15-year loan, right? Nope. Thirty-year fixed-rate mortgages dominated – accounting for more than 85 percent of…

Read more