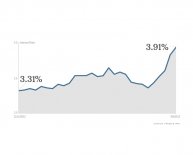

Mortgage Rates in the U.S

Patrick T. Fallon | Bloomberg | Getty Images

Patrick T. Fallon | Bloomberg | Getty Images

A sign advertising home mortgage services at a Bank of America branch in Manhattan Beach, Calif.

"When it comes to rates and financial markets in general, things can always go either way, but I will say that the past two days are the scariest we've seen since before Brexit, " wrote Matthew Graham, chief operating officer of Mortgage News Daily on Friday. "This is the kind of move that should be treated as a serious threat to low, stable mortgage rates until proven otherwise."

Higher mortgage rates make homebuying more expensive. No question. The move now could make some buyers want to get into a contract quickly before their costs rise. That, however, has always been a very short-term stimulus. Higher rates could also scare some sellers into lowering prices slightly, to sell before they lose potential buyers. For homeowners, this could be one more reason to jump on a mortgage refinance. Even with rates sitting at near-record lows for months, there are still hundreds of thousands of borrowers who have yet to take advantage and reduce their monthly payments.

But even if the Federal Reserve raises its funds rate this month, mortgage rates may not move much higher. After the central bank made its first increase last December, mortgage rates moved up briefly, but then fell again.

"The easiest way to say it is that 'longer-term' rates (stuff like 10-year Treasury yields and mortgage rates) do indeed tend to move with Fed rate hike expectations, not the Fed rate hike itself, " explained Graham. "Let December be your guide. The Fed hiked and rates fell. Now, why was that? Because rates had just spent the past 10 months rising in anticipation of an impending Fed rate hike."

So let's say rates rise a little bit in anticipation. There is only a small chance they would move a full percentage point higher. For that matter, mortgage rates have only gone up by half a percentage point 14 times since 1971, according to an analysis by John Burns Real Estate Consulting. Burns is predicting rates could stay below 4 percent at least through 2018. Still, a mortgage rate increase will have different outcomes for different segments of housing.

"Historically, they have hammered builder stocks, hurt new home sales bad, hurt existing home sales a little, and had very little impact on home prices unless there was a recession too, " noted John Burns. "My conclusion is that investors are right to punish the stocks, but often punish them too hard."