Government Mortgage Help

PAGE 2

Government-backed mortgages

The United Sates government has a long history of involvement in mortgage finance. During the 1930s, the government created the Federal Home Loan Banks (FHLB), the Federal Housing Administration (FHA), and the Federal National Mortgage Association (Fannie Mae). Since then, these programs grown in size and scope, and the government has introduced additional programs including…

Read more

Government help to Buy first home

Mortgage lenders have warned that the closure of help to buy could hit the first-time-buyer market. Photograph: Matt Cardy/Getty Images Philip Hammond has confirmed that the government’s help-to-buy mortgage guarantee scheme will be closed by the end of the year, another of former chancellor George Osborne’s flagships now abandoned by the Treasury. Launched in late 2013, the…

Read more

Programs to help Buy a home

MHO offers several programs to help families achieve the dream of homeownership: To participate, families or individuals must fall within the following income guidelines. And, as with any lending program, stable employment and good credit are necessary. Additional eligibility requirements may apply. Turn-Key Homeownership Program Looking for a home? MHO’s Turn-Key Homeownership…

Read more

Help to pay mortgage

As a homeowner, you’ve no doubt received flashy flyers or intriguing emails that offer to help you pay off your home faster through biweekly mortgage payments. It is true that biweekly payments will pay off your home faster and save money, but there’s no need to pay a company to set up the payments for you. The concept of a biweekly mortgage payment is pretty simple. You make…

Read more

Government funded mortgages

The federal government has a number of mortgage and affordable loan programs available that New York borrowers may qualify for. One of these may be just right for your particular situation, whether your need is a residential mortgage for the purchase of a new home, or a refinance of your existing home.. Here is some information on the government loan programs you may qualify…

Read more

Federal employees mortgage

Katie Miller, vice president of mortgage lending, with Kevin Parker, assistant vice president of field mortgage, and Paul Garcia, one of the credit union’s top loan officers, opened up to MReport journalist Xhevrije West and gave her a true inside look at what makes mortgage tick at Navy Federal. Here are some excerpts from the article: Finding products that meet members’ unique…

Read more

Who can help me pay my mortgage?

If nothing’s certain in life except death and taxes, a mortgage surely isn’t far behind—at least that’s the case for 70% of Americans, according to a recent study by Zillow. But have you ever stopped to imagine life without a mortgage? When you’re on a budget, it can be hard to picture. After all, you kinda like the whole eating-three-meals-a-day thing and don’t want to give…

Read more

Help mortgage

The NC Foreclosure Prevention Fund offers a Mortgage Payment Program to North Carolina homeowners who are struggling to make their home mortgage payments due to job loss or unemployment through no fault of their own or other temporary financial hardship such as a divorce, serious illness, death of a co-signor or natural disaster. Services are provided by HUD-approved counseling…

Read more

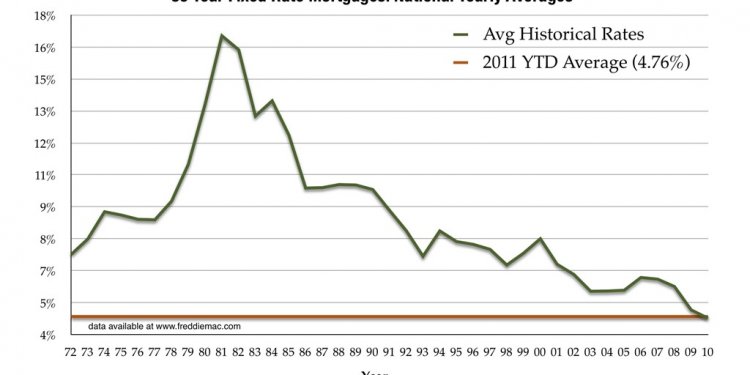

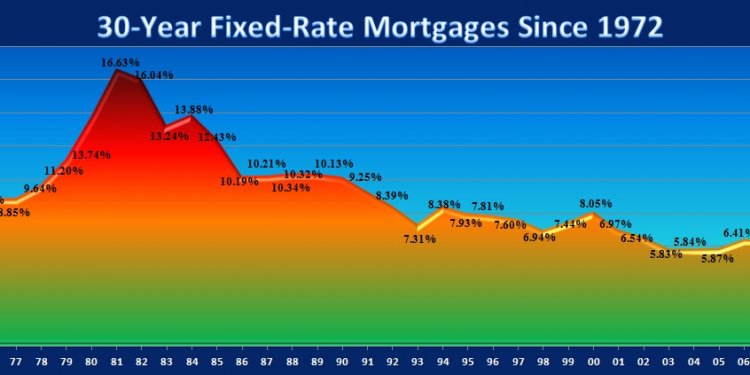

Historical jumbo mortgage rates

In an unusual twist, lenders are offering rates on jumbo mortgages that are more than a quarter of a percentage point lower than those on the conforming loans backed by Fannie Mae and Freddie Mac. The government-run agencies require conforming loans to be below $417, , unless they are for homes in high-cost areas like New York or Los Angeles, where the limit is $625, 500. Jumbo…

Read more

Government employees mortgage loans

Mortgages for Champions is proud to offer special home loans for government employees. With the special loans we offer, government employees are eligible for special rates and have much of the extra paper work, red tape and extra costs reduced. With these special home loans, government employees will have the Application Fee, the Loan Processing Fee, the Mortgage Underwriting…

Read more

Mortgage help for Homeowners

When you call the Iowa Mortgage Help Hotline you will reach a trained, respectful, nonjudgmental counselor at Iowa Mediation Services (IMS). When you call, please be prepared to provide the counselor with an honest explanation of your situation. Your truthfulness will allow the counselor to help you in the best way possible. After a brief conversation, the counselor will recommend…

Read more

20 Year Loans

Here’s a question a lot of people may be wondering … Is it really possible to have my federal student loans forgiven or to get help repaying them? The answer is: Yes! However, there are very specific eligibility requirements for each situation in which you can apply for loan forgiveness or receive help with repayment. Loan forgiveness means that you don’t have to pay back some…

Read more

Sovereign Bank mortgage Rates

Interest rates on some European mortgages have turned negative, creating an enormous headache for banks. Or at least that s what it feels like in Europe, where at least one bank is paying some customers who borrow from it because interest rates have turned negative. The European Central Bank has slashed official rates to record lows, and is pumping billions of euros into the…

Read more

Government Backed mortgage loans

Low Down Payment Conventional Loans Year after year, home buyers cite the down payment as their biggest obstacle to homeownership. Yet, in many parts of the country, you can buy a home with no money down. In fact, there are entire loan programs created specifically to help home buyers get into a home with as little down as possible. So, why do home buyers still think they…

Read more

Help to get a mortgage

“Finally it just deteriorated to where we couldn’t handle it, and that’s when we went for help. The Doane Family Loan Modification If you’re a service member struggling with your mortgage payment, you may qualify for a special military hardship. Additionally, military service members have protection against foreclosure for 9 months following termination of active duty. More…

Read more

Shopping mortgage rates

Buying a home is a big purchase, but it’s just that: a purchase. When it comes to spending money on our daily expenses, we have lots of options to help us find the best deal possible. Take, for example, digital gadgets. To get a good deal you can search for sales, find coupon codes, and research whether it’s less expensive to buy something from a big box retailer or on the…

Read more

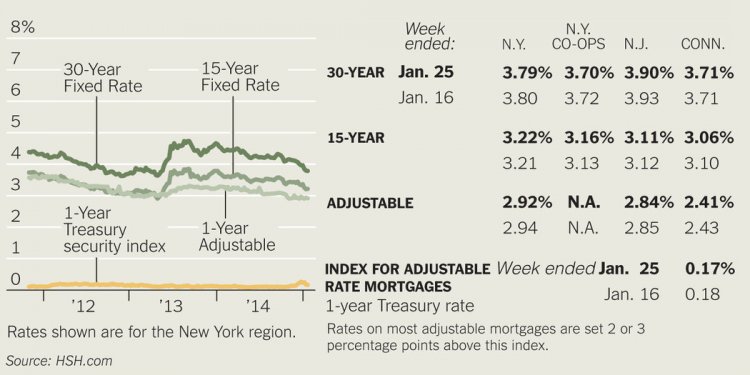

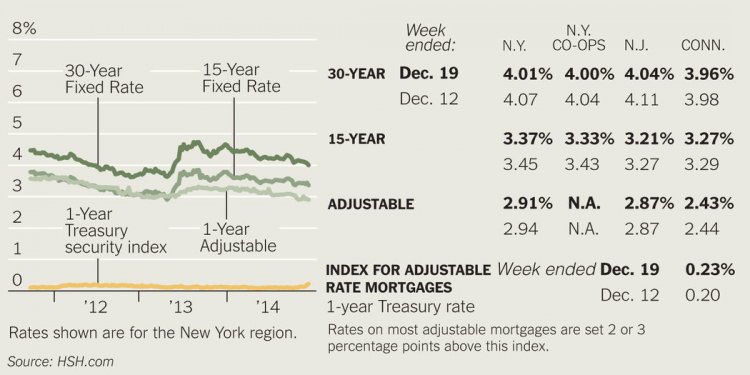

Current mortgage rates 30 Yr fixed

Several closely watched mortgage rates inched up today. The average rates on 30-year fixed and 15-year fixed mortgages both increased. On the variable-mortgage side, the average rate on 5/1 ARMs were down. Rates for mortgages are constantly changing, but they remain low by historical standards. If you re in the market for a mortgage, it may make sense to lock if you see a rate…

Read more

Alaska mortgage rates

The median national average for owner-occupied homes is $144, 200. The average in Alaska is $119, 600, making Alaska s home prices 7.1% below average at the end of 2009. Fortunately, this shouldn t be too worrying since price averages fluctuate. Most Popular & Fastest Growing City: Anchorage Anchorage is Alaska s most popular and fastest growing city-borough. Slightly…

Read more