Federal mortgage help

Correcting a comment from J.P. Morgan spokesman in the 10th paragraph

Correcting a comment from J.P. Morgan spokesman in the 10th paragraph

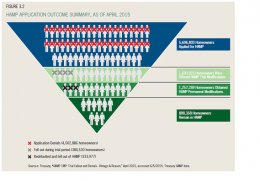

WASHINGTON (MarketWatch) — Mortgage servicers reject 72% of struggling borrowers from a federal program aimed at creating more affordable monthly mortgage payments so owners can keep their homes, a federal watchdog reported Wednesday.

“All cannot be right, ” said the special inspector general for the Troubled Asset Relief Program, a federal bailout enacted in 2008 to protect the U.S. and financial firms from a financial tsunami.

According to the inspector’s quarterly report to Congress, Citigroup Inc. C, -1.45% has rejected 87% of applications for TARP’s Home Affordable Modification Program, which aims to make mortgages more affordable by changing terms, such as interest rates and loan duration. J.P. Morgan Chase & Co. JPM, +0.05% has rejected 84% of applications, Bank of America Corp. BAC, +1.39% has rejected 80% and Ocwen Fianncial Corp. OCN, -1.87% has rejected 70%.

“There is a massive lost opportunity for an emergency program designed to help homeowners through the crisis if only 20% to 30% of families seeking help from HAMP actually get into HAMP, ” said Christy Romero, special inspector general.

Moreover, the U.S. Treasury Department’s requirements for servicers to explain why borrowers were rejected “do not give a clear picture of why homeowners were denied, ” the report said. Also, the report noted that officials have found that servicers have “wrongfully denied” borrowers from entering HAMP.

“Persistent problems and errors in the application and income calculation process (servicers calculate a homeowner’s income) have historically plagued homeowners seeking HAMP assistance, and continue to do so, ” the report said.

The watchdog said Citi “has had one of the worst records of non-compliance” with Treasury’s guidance for reviewing applications, failing to meet benchmarks in most reviews.

“Citi is the only large active servicer that has ever been rated as needing ‘substantial improvement’ with respect to denial determinations, ” the report said.

A Citi spokesman said the company has “consistently addressed issues” in quarterly performance reports, “and has fully implemented corrective action plans to remedy them.”

A J.P. Morgan Chase spokesman said Chase “has achieved the Treasury’s highest overall MHA compliance scorecard rating for six of the last seven quarters.

“We believe today’s reported findings are based on an inaccurate analysis of Treasury data, and that both HAMP and our participation in HAMP have helped to achieve the program’s goals.”