Refinance Mortgage

PAGE 2

Need help Buying a home

If you’re thinking about buying a home, you may wonder whether you need a real estate agent. There are plenty of resources for a buyer these days, from online search sites to how-to guides. But an agent has something no buyer – particularly a first-time buyer – does: a wealth of experience. An agent will work as an advocate on your behalf and, in most cases, will get you a…

Read more

USAA mortgage Refinance reviews

USAA Mortgage is part of a unique financial services firm. While USAA is neither simply a bank nor a credit union, it shares characteristics with both. The company formed in 1922 when 25 U.S. Army officers who couldn’t get auto insurance because they were considered a poor risk decided to insure one another’s vehicles. USAA is still in the insurance business, but it also offers…

Read more

USAA VA mortgage Refinance

VA IL The VA IL is a refinance mortgage loan available to homeowners with existing VA mortgages. The program, which is commonly known as the VA Streamline Refinance, simplifies home refinancing by waiving the documentation typically required by a bank, including income and employment verification, bank account and credit score verification, and an appraisal of the home. This…

Read more

Refinance mortgage Rates government

FHA Streamline The FHA Streamline is a refinance mortgage loan available to homeowners with existing FHA mortgages. The program simplifies home refinancing by waiving the documentation typically required by a bank, including income and employment verification, bank account and credit score verification, and an appraisal of the home. Homeowners can use the program to reduce…

Read more

10 year mortgage Refinance

You may not know that you can refinance with fixed rate mortgages with terms ranging from five to more than 40 years - not just the popular 30-year and 15-year refinances. One such “oddball” refinance loan is the 10-year fixed mortgage loan. What Is It? The 10-year fixed refinance takes just ten years to repay. When you repay a fixed refinance, part of the monthly amount covers…

Read more

USAA mortgage Rates points

SECURE SELFIES: USAA says 101, members have already begun using its face and voice recognition to access mobile banking. USAA is letting its members log in to mobile banking in the blink of an eye literally. The San Antonio financial services company has rolled out facial recognition technology across its entire membership base that lets them access its mobile app with a…

Read more

Mortgage incentives

A Morningstar analyst once opined that if traditional banks are like Volvos, mREITs are like race cars - without seat belts or airbags. That may be the best one-sentence description ever written on mortgage REITs. The mREIT business model is quite simple in that it s very bank-like. Mortgage REITs borrow money at a low interest rate to invest in mortgages that pay a slightly…

Read more

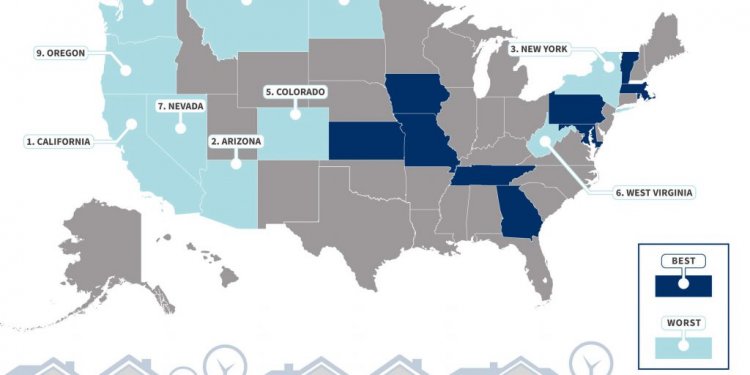

Best 10 year mortgage Refinance Rates

What kinds of mortgages are available in Colorado? Are the loans recourse or non-recourse? What is the foreclosure process like in Colorado? What are the average real estate prices in Colorado, and how do they compare with other states? What are the most popular, and what are the fastest growing cities in the state? This article will examine those topics in depth. Average Real…

Read more

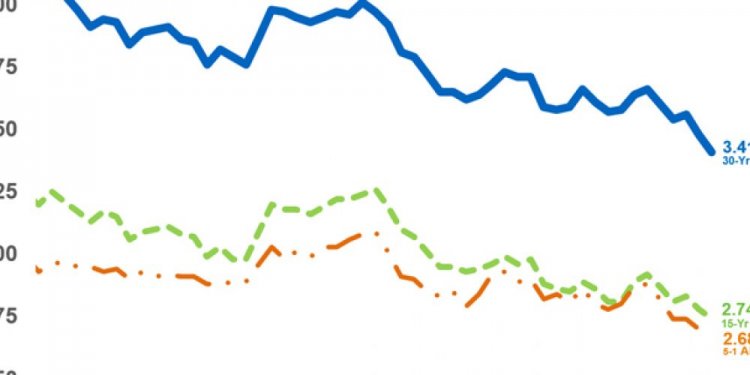

U.S. mortgage rates

The average rate of a 30-year fixed mortgage dropped to 3.48% - the lowest level since May 2013, according to Freddie Mac. A year ago, the rate was 4.08%. The rate on the 15-year fixed mortgage also dropped to 2.78% from 2.83% last week. Obviously it s a good time for anyone who is the market for a home purchase or had been on the proverbial fence about refinancing,said Mark…

Read more

5 year Refinance mortgage Rates

ARM Mortgage Rates Average 2.99% According to Freddie Mac s most recent mortgage rate survey, 30-year fixed rate mortgages currently average 3.93 percent nationwide; and, 15-year fixed rate mortgages average 3.16%. However, for the right borrower, the 5-year adjustable-rate mortgage (ARM) looks excellent. The popular ARM loan now averages 2.93%. Mortgage Rates: 4.25 Points…

Read more

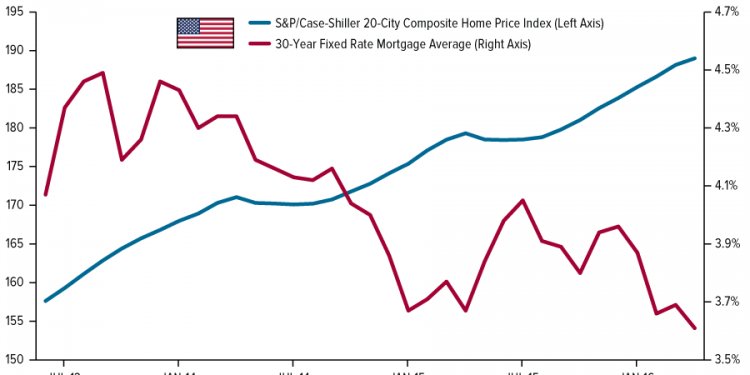

USAA Bank mortgage Refinance

Brexit, the recent vote by Britain to leave the European Union, has roiled markets worldwide. One surprising benefit, at least for U.S. homeowners, has been that rates for 10-year Treasury bonds have dropped to near-historic lows. The resulting low mortgage interest rates are prompting some homeowners to wonder if this is the right time to consider refinancing their home. “Investors…

Read more

Cheapest Mortgages

It s the cheapest ever fixed-rate mortgage - but is it marketing spin or could you save? Mortgage rates have been dropping fast, but the news you can now get a two-year fixed-rate mortgage charging just 0.99% interest is still remarkable. But while the headline rate is stunning – and the deal is open to both people buying a home and those re-mortgaging – it s not without catches…

Read more

10 year mortgage loan

A 10-year fixed rate mortgage offers a low interest rate and accumulates much less interest than other loans due to its shorter term. That means that you can build equity quickly compared to longer fixed rate loans (i.e., 15- or 30-year loans). This type of mortgage could be a great option for someone who can afford a higher monthly payment or a higher down payment. Benefits:…

Read more

First home Owners grant USA

A happy couple standing at the front door of thier home. First-time Buyer Basics Most homebuyer grants and all grants administered by the federal government require first-time homebuyer education. The financial counseling courses prepare you for the mortgage application process and help you budget for homeownership. To get a grant, you must qualify for a mortgage, which will…

Read more

Help with refinancing home mortgage

Getting a new mortgage to replace the original is called refinancing. Refinancing is done to allow a borrower to obtain a better interest term and rate. The first loan is paid off, allowing the second loan to be created, instead of simply making a new mortgage and throwing out the original mortgage. For borrowers with a perfect credit history, refinancing can be a good way…

Read more

Loan View

Auto Loans (New and Used) As the price of a new car has risen, the decision to buy has become a major financial transaction. Let us help with our fixed-rate simple-interest loans. Call the numbers listed below to start the application process for your next car loan: CD Loans Borrow against your certificate of deposit for any needs you may have (excluding IRA CDs). We offer…

Read more