Refinance mortgage Rates government

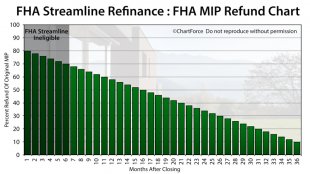

FHA Streamline

The FHA Streamline is a refinance mortgage loan available to homeowners with existing FHA mortgages. The program simplifies home refinancing by waiving the documentation typically required by a bank, including income and employment verification, bank account and credit score verification, and an appraisal of the home. Homeowners can use the program to reduce their FHA mortgage insurance premiums (MIP).

NOTE: FHA mortgage guidelines change often. This FHA Streamline Refinance information is accurate as of today, November 14, 2016.

What Is An FHA Streamline Refinance?

The FHA Streamline Refinance is a special mortgage product, reserved for homeowners with existing FHA mortgages.

The FHA Streamline Refinance program's defining characteristic is that it does not require a home appraisal.

Instead, the FHA will allow you to use your original purchase price as your home's current value, regardless of what your home is actually worth today.

In this way, with its FHA Streamline Refinance program, the FHA does not care if you are underwater on your mortgage. Rather, the program encourages underwater mortgages.

Even if you owe twice what your home is now worth, the FHA will refinance your home without added cost or penalty.

The "appraisal waiver" has been a huge hit with U.S. homeowners, allowing unlimited loan-to-value (LTV) home loans via the FHA Streamline Refinance program.

Homeowners in places like Florida, California, Arizona and Georgia have benefitted greatly, as have homeowners in other states and cities affected by last decade's housing market downturn.

Beyond this "no appraisal" feature, however, the FHA Streamline Refinance behaves very much like any other loan product.

It's available as a fixed rate or adjustable mortgage; it comes as a 15- or 30-year term; and there's no FHA prepayment penalty to worry about.

FHA Streamline : No Verification Of Job, Income, Credit

Another big plus is that the FHA Streamline Refinance is fairly easy for which to qualify.

Earlier this decade, in an effort to help U.S. homeowners, the FHA abolished most of the typical verifications required to get a mortgage. So, today, as it's written in the FHA's official mortgage guidelines :

- Employment verification is not required with an FHA Streamline Refinance

- Income verification is not required with an FHA Streamline Refinance

- Credit score verification is not required with an FHA Streamline Refinance

There's no need for a home appraisal, either, so when you put it all together, you can be (1) out-of-work, (2) without income, (3) carry a terrible credit rating and (4) have no home equity. Yet, you can still be approved for an FHA Streamline Refinance.