USAA mortgage Refinance reviews

USAA Mortgage is part of a unique financial services firm. While USAA is neither simply a bank nor a credit union, it shares characteristics with both. The company formed in 1922 when 25 U.S. Army officers who couldn’t get auto insurance because they were considered a poor risk decided to insure one another’s vehicles.

USAA Mortgage is part of a unique financial services firm. While USAA is neither simply a bank nor a credit union, it shares characteristics with both. The company formed in 1922 when 25 U.S. Army officers who couldn’t get auto insurance because they were considered a poor risk decided to insure one another’s vehicles.

USAA is still in the insurance business, but it also offers banking, credit cards, loans and investment advice. And, like a credit union, USAA is owned by its members, which can be anyone who has ever “honorably served in the U.S. armed forces and their direct dependents.”

Here’s how USAA Mortgage compares to stiff competition in the crowded home loan industry.

NerdWallet is a free tool to find you the best credit cards, cd rates, savings, checking accounts, scholarships, healthcare and airlines. Start here to maximize your rewards or minimize your interest rates.

AT A GLANCE

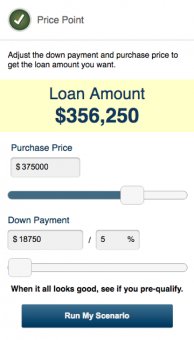

- Minimum loan amount $50, 000; maximum up to $3 million.

- Minimum credit score of 620.

- 65% of loans are backed by the VA.

USAA Mortgage specializes in VA loans

USAA serves all 50 states and the District of Columbia, but not through a network of local offices. USAA is “100% consumer direct, ” meaning most business is conducted over the phone.

“We traditionally have [served] a lot of first-time homebuyers, ” says John Harrell, vice president of USAA Mortgage. The average loan size is $230, 000. “Our bread-and-butter member is that active-duty [non-commissioned officer] or recently separated veteran, and many times buying that first home that is in that $230, 000 range.”

Even though USAA offers conventional loans with as little as 3% down, considering its military membership, VA loans are the core offering for first-time homebuyers. As a result, USAA doesn’t offer FHA or USDA loans.

Home equity loans and lines of credit are unavailable at USAA. Harrell says after a loan origination system upgrade is completed, perhaps by the end of 2017, HELOCs will make a return.

» MORE: How to calculate your monthly mortgage payment

USAA’s mortgage loan fees

“By our measure, we look to be about half price. It’s very typical to see a one-point (1%) origination fee. We also don’t really have any of what I would call junk fees. So an underwriting fee, or a documentation fee. We don’t have any of those kinds of fees, ” Harrell says.

Perhaps the best mortgage deal at USAA is a streamlined — meaning less paperwork — VA refinance. The VA Interest Rate Reduction Refinance Loan (IRRRL) has no origination fee, and USAA covers the appraisal, title and VA funding fee.