Interest Rates Comparison

PAGE 2

Best rates for mortgage Loans

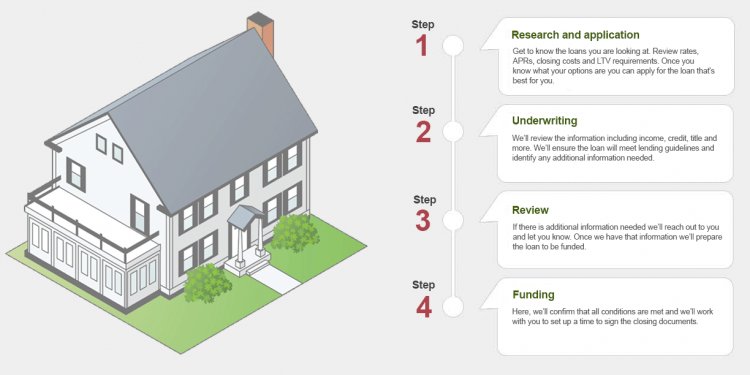

If you’re buying a house, you want to get into the lowest mortgage rate possible. After all, mortgages are a commodity. You don’t get extra special benefits for paying more every month. Let’s take a look at how each of these factors can affect the rate you get. After that, we’ll go over some strategies that can help you qualify for a low rate. Factors Affecting Your Mortgage…

Read more

SONYMA Rates

If you re ready to buy a home, we’re ready to help! Call us today at 1-800-382-HOME (4663) One of the biggest obstacles to owning a home is the amount of funds a borrower must have for downpayment and closing costs. To help applicants overcome this obstacle, SONYMA offers homebuyers down payment assistance in conjunction with SONYMA financing. Please read below for details…

Read more

Help me get a Home

I am asking for your help for dear friends of mine, The Sneesby family. Their daughter Phelicity was born with a congenital heart defect 13 years ago. Her defect was so complex, it brought them all the way from Australia to Columbus, Ohio where they sought treatment from a specialist. Her condition worsened and they returned to Ohio. Her mother, Veronica, has been off work…

Read more

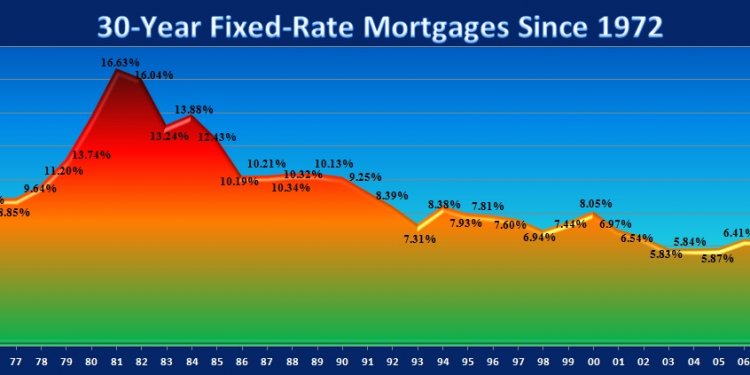

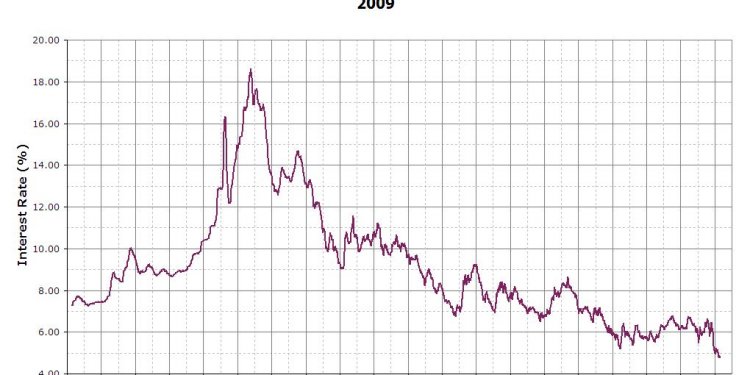

Current Fixed mortgage Rates 30 Year

Multiple benchmark mortgage rates cruised higher today. The average rates on 30-year fixed and 15-year fixed mortgages both floated higher. Meanwhile, the average rate on 5/1 ARMs also advanced. Mortgage rates are constantly changing, but, overall, they are very low by historical standards. If you re in the market for a mortgage, it may make sense to lock if you see a rate…

Read more

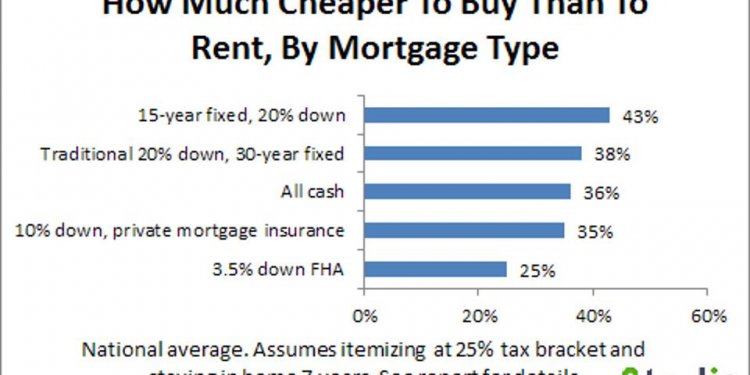

Different types of loans for mortgages

Federal and state first-time-buyer programs can lend you a hand. There are few things as exciting, and overwhelming, as buying your first home. The first hurdle most first-time home buyers face is finding the cash they need for a down payment. A second problem is finding a lender that will give them the time of day if they are low-income consumers or don t have much of a credit…

Read more

20 Year Refinance Rates

Everyone loves saving money, especially when it comes to most homeowners’ largest monthly expense: the mortgage. Maybe you’re looking to cut that bill by refinancing your mortgage. Or maybe you’re thinking about refinancing because you’re afraid interest rates are heading up and it’s your last chance to grab a better deal. Mortgage rates are still historically low and you may…

Read more

15 Yr FHA mortgage Rates

Mortgage Rates Roll Back To 3.41% According to Freddie Mac, 30-year fixed rate mortgage rates dropped to 3.41% this week, on average - the lowest in 1, 169 days. Rates weren t supposed to drop in 2016. But they have. 30-year mortgage rates have dropped in two-thirds of this year s calendar weeks and pricing is now the best its been since May 2013. Borrowers report receiving…

Read more

Ten Year mortgage

With the ten year yield falling to 1.65%, there has been some discussion about whether mortgage rates will decline to new lows. Based on an historical relationship, 30-year rates should currently be around 3.55%. As of yesterday, Mortgage News Daily reported: Mortgage Rates Even Closer to All-Time Lows If rates are able to move any lower from here, that will put them in line…

Read more

Obama Home Buying program

PHOENIX - A new White House initiative could put hundreds of dollars back into the pockets of homeowners with mortgages through the Federal Housing Authority, President Obama says. Obama has directed the FHA to reduce the fees attached to government loans for home buyers by half a percent, from 1.35 to 0.85 percent. It may seem like a paltry figure, but the White House estimates…

Read more

Remortgage deals

Our guide to remortgaging can help you decide if switching from your current mortgage deal is right for you Paying off your existing mortgage with a new one can offer flexibility, a better deal on your monthly repayments or an opportunity to consolidate your debts. Remortgaging can also save you thousands of pounds, but it comes down to your personal circumstances. Continue…

Read more

Home interest Rates Comparison

Mortgage Rates Mortgage rates are the interest rates assigned to a home loan, which is commonly known as a mortgage . Mortgage rates are based on the price of mortgage-backed securities (MBS), which are bonds backed by U.S. mortgages. Mortgage rates vary between conventional, FHA, VA, USDA, and jumbo loans; and, by mortgage lender. How Mortgage Rates Are Made Huge numbers…

Read more

5 Year Mortgage Rates

The 30-year, fixed-rate mortgage fell this week to just above its all-time lowest level. And people already are taking advantage, flooding mortgage companies with refinance applications. The benchmark 30-year fixed averaged 3.52% this week. The record low is 3.5%, set in December 2012. I m betting that it will go even lower. At the same time, I encourage you to lock your rate…

Read more