15 Yr FHA mortgage Rates

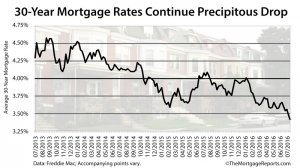

Mortgage Rates Roll Back To 3.41%

According to Freddie Mac, 30-year fixed rate mortgage rates dropped to 3.41% this week, on average - the lowest in 1, 169 days.

Rates weren't supposed to drop in 2016. But they have.

30-year mortgage rates have dropped in two-thirds of this year's calendar weeks and pricing is now the best its been since May 2013. Borrowers report receiving rates approaching 3.25 percent, with VA and FHA mortgage rates going even lower.

A series of unexpected events - a shift in Federal Reserve expectations, a vote in the U.K. to leave the Eurozone, and a strengthening U.S. dollar - have combined to hold U.S. rates low.

More than 8 million U.S. homeowners are currently refinance-eligible. Maybe you're one of them.

You'll want to refinance soon, though. While today's low mortgage rates are likely to last at least another few weeks, there's never any such guarantee.

Have you seen what you can save with a refinance?

Is It Too Late To Refinance?

The average 30-year fixed rate mortgage rate shed 7 basis points (0.07%) this week to reach 3.41%, on average, nationwide.

These rates, available to prime borrowers paying an accompanying 0.5 discount points at closing, vary slightly by region; and require borrowers to pay typical home loan closing costs.

Closing costs are defined as fees paid as part of a mortgage transaction, whether purchase or refinance.

Closing costs include origination points assigned by banks; appraisal fees charged by appraisers; and, charges for services such as credit reports and flood certifications.

For such borrowers, there's the zero-closing cost mortgage.

A zero-closing cost mortgage doesn't really have "zero closing costs". It has all of the costs of a "regular" loan. What makes the zero-closing cost mortgage different is that, on the settlement statement, it's the lender which pays the costs - not the borrower.

In exchange for paying costs, the lender will up-charge on the mortgage rate.

In general, a $250, 000 mortgage can have its closing costs "waived" in exchange for a 25 basis point (0.25%) increase to the mortgage rate, or $35 extra per month.

If you refinance today at 3.25% with zero closing costs, then mortgage rates drop to 2.75% in late-2017, you can refinance again with no sunk costs in the transaction (i.e. unrecoverable closing costs).

Savvy borrowers used this strategy between 2009-2013 to "serial refinance" their loans, lowering from the six percents with no closing costs paid ever.

Refinance Loans As "Low-Hanging Fruit"

Mortgage rates are low, which makes today an attractive time to refinance. There's a lot of money to be saved, after all.

According to Freddie Mac, as a group, last year's refinancing households will save $5 billion dollars in the first 12 months of new, refinanced loan. And, last year, rates were 60 basis points (0.60%) higher than what they are today.

This year's refinancing homeowners will save even more.

If you're not sure whether you should refinance or whether you'll get approved, consider the following list. Each of these homeowner types may be in position to refinance and save big money.

The typical refinancing homeowner is saving more than 20% annually.

Homeowners Who Purchased In 2015

If you purchased your home in 2015 and have not yet refinanced, it's time to consider today's new rates.

Even a quarter-point drop can make sense if you limit your closing costs to nothing.

Homeowners With Burdensome Credit Card Debt

If your credit card feels burdensome (or larger than you'd like), it's a good time to consider a refinance.

Home values have climbed more than 30% since 2012 and, in many U.S. markets, values have eclipsed last decade's all-time peak. Your home equity position is building and that equity can be used for a cash-out refinance to reduce or eliminate debts.

Homeowners Paying Private Mortgage Insurance

If you agreed to pay private mortgage insurance (PMI) as part of your current mortgage, consider a refinance to get rid of it or reduce it.

PMI rates are based on your home's loan-to-value (LTV) at the date of purchase or refinance; and, PMI increases with every five percentage point increment. A loan at 90% LTV, for example, pays a higher rate of PMI than a loan at 85% LTV.

Refinancing your loan with PMI can get you access to today's lower rates and assign to you a new, lower rate of PMI.

Homeowners Paying FHA MIP

If your current mortgage is FHA-backed, you're paying FHA mortgage insurance premiums (MIP) and FHA MIP never goes away. However, you can eliminate it.

For FHA-backed homeowners whose home equity percentage is 10% or more, it's an excellent time to refinance to a conventional mortgage instead.

Initially, payments may be higher because FHA rates are lower than rates for conventional loans; and FHA MIP rates can be lower than the rates for private mortgage insurance, too. However, PMI for conventional loans eventually goes away. FHA MIP never does.

This strategy is especially clever for budget-conscious consumers.

Homeowners Wanting A Clever Way To Save Big Money

Another good refinance option is the conversion of an existing 30-year fixed rate mortgage to something of a shorter term (e.g.; 15-year mortgage).

This is money which can be used for any purpose possible, including the funding of a retirement account, making college tuition payments for a child, or anything else.

The 15-year fixed-rate mortgage averages 2.74% nationwide.

What Are Today's Mortgage Rates?

Mortgage rates are near their lowest levels of the year, and may head lower into 2017. Or, this may be the lowest they ever go. With a zero-closing cost mortgage, you can hedge that risk.

Get today's live mortgage rates now. Your social security number is not required to get started, and all quotes come with access to your live mortgage credit scores.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.