Current Fixed mortgage Rates 30 Year

Multiple benchmark mortgage rates cruised higher today. The average rates on 30-year fixed and 15-year fixed mortgages both floated higher. Meanwhile, the average rate on 5/1 ARMs also advanced.

Multiple benchmark mortgage rates cruised higher today. The average rates on 30-year fixed and 15-year fixed mortgages both floated higher. Meanwhile, the average rate on 5/1 ARMs also advanced.

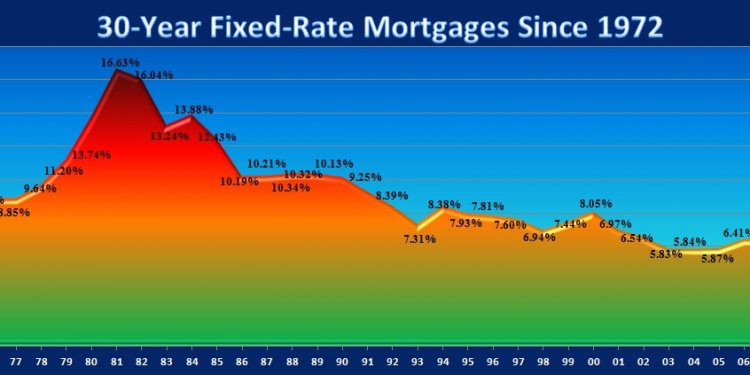

Mortgage rates are constantly changing, but, overall, they are very low by historical standards. If you're in the market for a mortgage, it may make sense to lock if you see a rate you like. Just be sure to shop around.

30-year fixed mortgages

The average 30-year-fixed mortgage rate is 3.51 percent, up 7 basis points since the same time last week. A month ago, the average rate on a 30-year fixed mortgage was lower, at 3.34 percent.

At the current average rate, you'll pay a combined $449.60 per month in principal and interest for every $100, 000 you borrow. That's an increase of $3.90 over what you would have paid last week.

You can use Bankrate's mortgage calculator to figure out your monthly payments and find out how much you'll save by adding extra payments. It will also help you calculate how much interest you'll pay over the life of the loan.

15-year fixed mortgages

The average 15-year fixed mortgage rate is 2.80 percent, up 8 basis points over the last week.

Monthly payments on a 15-year fixed mortgage at that rate will cost around $681 per $100, 000 borrowed. The bigger payment may be a little harder to find room for in your monthly budget than a 30-year mortgage payment would, but it comes with some big advantages: You'll come out several thousand dollars ahead over the life of the loan in total interest paid and build equity much faster.

5/1 adjustable-rate mortgages

The average rate on a 5/1 ARM is 3.04 percent, ticking up 6 basis points over the last week.

These types of loans are best for those who expect to sell or refinance before the first or second adjustment. Rates could be substantially higher when the loan first adjusts, and thereafter.

Monthly payments on a 5/1 ARM at 3.04 percent would cost about $424 for each $100, 000 borrowed over the initial five years, but could increase by hundreds of dollars afterward, depending on the loan's terms.