Bank Rates.com Mortgage Rates

Rawpixel.com / Shutterstock.com

Rawpixel.com / Shutterstock.com

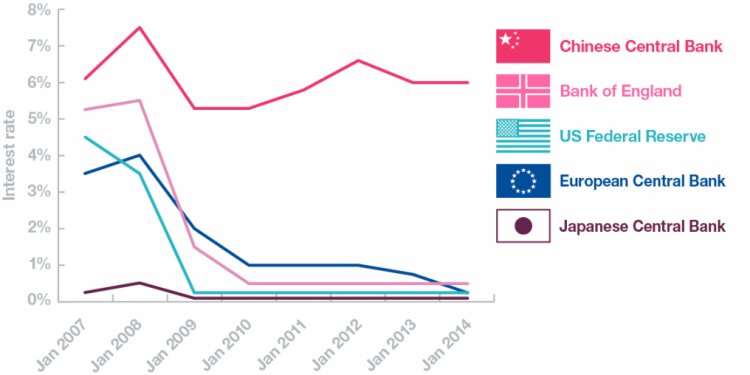

Refinancing might be tricky for homeowners facing obstacles like sub-par credit, little equity in their homes, or worse yet, homes that are currently worth less than they’re mortgaged for. But thanks to the Federal Housing Administration, refinancing to potentially better FHA rates has become a reality for many homeowners.

A refinance could help you restructure your mortgage to take advantage of today’s mortgage rates and might also give allow you to factor in any accrued home equity to lower your monthly payments. Refinancing your home could make enough of a difference that you might even avoid default or foreclosure, too. Read on to learn more about FHA loan requirements plus get the scoop on current refinance rates.

Types of FHA Refinance Loans

FHA refinance loans fall into two categories: No Cash-Out Refinances and Cash-Out Refinances. In a No Cash-Out Refinance the mortgage proceeds don’t include extra cash for anything other than paying out the current FHA mortgage. A Cash-Out Refinance refers to any mortgage or withdrawal of equity on which there isn’t a current mortgage, and the proceeds aren’t restricted to a specific purpose

No Cash-Out: FHA Streamline Refinance for Lower Interest Rates

FHA Streamline Refinance mortgages are No Cash-out Refinances because the mortgage proceeds can only be used to pay out the current FHA mortgage.

An FHA Streamline Refinance can only be used to refinance an existing FHA loan. The main advantage is that the approval process is faster or “streamlined” because the lender only requires limited documentation and paperwork. And if you’re refinancing your FHA mortgage within three years of getting it, a refund credit could help reduce your upfront mortgage insurance premium. It might also allow you to take advantage of today’s refinanced mortgage rates.

Another advantage of this type of mortgage is that some lenders offer the option to get an FHA refinance without any out-of-pocket expenses. Lenders can do this by charging a higher interest rate and then paying for the closing costs with the premium they charged. So this might be an option if you’re short on cash right now. An FHA mortgage calculator can help you see what your payments might be.

Because an FHA Streamline Refinance doesn’t require a new home appraisal, it’s a good option for someone who owes more on their mortgage than their home is worth. However, to qualify for this refinance the mortgage must be current, so it’s not an option for borrowers who are behind on their payments.

Here’s what is not required to get an FHA Streamline Refinance:

- Home appraisal

- Credit check for non-credit qualifying

- Income verification

No Cash-Out Refinance: FHA Rate and Term

With a Rate and Term FHA Refinance, all the proceeds of the new mortgage are used to pay off the old one when you refinance your home. An FHA Rate and Term Refinance is a good choice for homeowners with any type of mortgage who want to take advantage of current interest rates and/or better terms. And since borrower-paid costs — such as repairs required by the appraisal — can be rolled into the mortgage, it’s also good for borrowers with fewer funds on hand. In fact, you can actually receive up to a maximum of $500 cash back under this FHA refinance mortgage.