Best fixed rate mortgages 10 Year

A 10 year fixed rate mortgage deal will fix your interest rates and monthly repayments at the same level for 10 years.

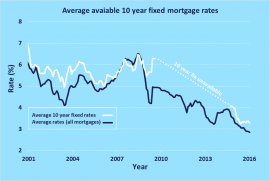

10 year fixed rate mortgages all but disappeared after the financial crisis of 2008, but returned at then end of 2014. Is it a good idea to fix your rate for 10 years?

Fixing the rate on your mortgage for 10 years offers peace of mind as you can budget well into the future, but the dilemma is whether by fixing you’ll miss out on the most competitive rates and be stuck on a relatively expensive rate.

However, with rates hovering at record lows, 2016 could be a very good year to switch to a fixed rate mortgage.

Interest rates in 2016: nowhere to go but up?

Interest rates for mortgages fell and fell as 2014 came to an end, with the all time lowest rate coming from HSBC with a 0.99% introductory rate for their variable mortgage.

Rates remained low throughout 2015, and while HSBC have quietly withdrawn their 0.99% deal, a few rates under 1% remain on the market.

The base rate of lending from the Bank of England (the interest rate banks borrow at and a big decider in the price of mortgage rates) has been at historic lows of 0.5% since 2009.

However rate rises have been mentioned as a possibility since spring 2014. Bank of England Governor Mark Carney has said he will gradually increase rates in the near future up to around 2.5%, but when he will do this remains a mystery.

But for now, all we can guess with any certainity is that interest rates will go up, by how much and when is guesswork. You can read more about this in our guide on when to fix your mortgage rate.

What are the advantages of a 10 year fixed rate mortgage?

The most obvious advantage is that your mortgage costs are fixed for the long term: your rate and your monthly repayments will stay the same for ten years.

This makes budgeting very manageable, as you know if you can afford your repayments now you’ll be able to afford them in the future. So you can accurately predict your living expenses and manage your finances.

You may also save a lot of money relative to having a variable rate, if interest rates shoot up.

What are the disadvantages of fixing a rate for 10 years?

You are stuck on this rate for 10 years and you will have to pay exit fees to switch to a new mortgage. So if interest rates become cheaper you’ll be lumped with your more expensive rate.

For example, if you got a fixed rate in 2007, you would be relatively much worse off than those on variable mortgage rates, which plummeted during the financial crash leaving them with very cheap rates.

How much could I save by remortgaging with a 10 year fix?

If you think you could benefit from changing mortgage, you will of course need to consider how much it will cost you to remortgage, against how much you stand to save in the long term.

The costs

- Arrangement fee – Anything from £0 up to £2, 500.

- Booking fee – Typically £99-£300.

- Telegraphic transfer fee – Typically £25-£50.

- Valuation fee – Usually £150-£1, 500 (depends on your property value).

- Mortgage account fee- Typically £100-300.

- Mortgage broker fee – This is normally around £500, but can also be a commission percentage of the value of your mortgage.

- Exit/Closure fee – Usually £75-£300.

- Early repayment charge – Typically between 1–5% of the value of your remaining loan, but typically only applies within a specific time frame (e.g. up to 4 years after the mortgage was taken out) and not all lenders charge this.

The savings

You need to think long term with your savings, taking into account your interest rates for the next few years and how much interest you have to pay on your remaining mortgage debt.

If you only have a have a few years and a small amount left to repay on your mortgage, it may well not be worth remortgaging once you take into account the fees, cost and hassle.

However, if you still have a substantial amount to repay and many years left, remortgaging you could save thousands over the next few years. Especially if rates do go up as expected.