Lowest 5 Yr fixed rate mortgage

I must be mad, because after multiple mortgage refinances, I’ve decided to take my own advice on improving my cash flow further by trying to refinance my mortgage again! I say “trying” because getting a mortgage or refinancing a mortgage is still not a slam dunk like it was pre-2007.

I must be mad, because after multiple mortgage refinances, I’ve decided to take my own advice on improving my cash flow further by trying to refinance my mortgage again! I say “trying” because getting a mortgage or refinancing a mortgage is still not a slam dunk like it was pre-2007.

Lending standards are strict with ~729 being the average credit score for denied mortgage applicants. Furthermore, my debt-to-income ratio could be a problem because 100% of my 1099 (freelance income) won’t count for 2014 because banks require two years of 1099 income, and I’ve only got 14 months worth.

Can you believe that? Even if I made $800, 000 in freelance income over the past twelve months, big banks would still disavow all of it and likely reject even a small mortgage refinance amount if I had no other income. Banks should discount 1099 income by some amount, but not by 100%. There’s a growing misconception now that full-time income is more stable. A full-time employee is betting on one horse. An independent contractor can bet on multiple horses.

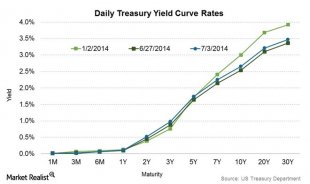

We’re close to all-time lows again in 2H2015. Volatility is up, collapsing oil prices are stoking fears of weak global consumer demand, and chaos reigns once again in Europe. I’m glad there isn’t anymore US government shutdown drama at the very least.

I’ve got two years left on a ~$1 million dollar jumbo 5/1 ARM at $4, 338 a month at 2.625%. My goal is to refinance this puppy down to a 2.25% 5/1 ARM at $3, 822 a month, for a cost of less than $3, 000. The annual interest savings is $3, 750, and the monthly cash flow increase is $516 or $6, 192 a year. That’s a good move towards my unwavering quest to generate $200, 000 a year in passive income.

HOW TO GET THE LOWEST MORTGAGE RATE POSSIBLE

I’ve looked everywhere, and I can’t find a better rate than 2.25% for a 5/1 ARM jumbo with zero points. This is what I did:

1) Pressed my existing mortgage lender: I called Citibank, the bank that has my $1 million loan, and asked what they could give me. They first said 2.625%, which is exactly what my rate is now. I pressed them to give me a deal as a CitiGold client, so they brought the rate down to 2.375% at the end of our negotiations. This was not good enough because a mortgage refinance takes time and costs money. Saving 0.25% would only be worth it if I had a million+ mortgage. My trusty Citimortgage officer who did my other deals had left.

2) Shopped around online: I then filled out my mortgage details on LendingTree Mortgage to see what their bankers could come up with. I like LendingTree because they have one of the largest mortgage lending networks online, and they aggressively compete for your business. Within five minutes of filling out the application, I got several phone calls and e-mails. They are super efficient, so don’t be surprised. I wanted to use LendingTree to make sure Citibank was indeed providing a good rate. Some of the LendingTree-referred bankers said they could match 2.375%, while one said he could do 2.25%, but for a quarter point in cost. It’s not a problem to get a mortgage with an institution that might not have a branch close by. But I prefer having a branch I can walk into and talk to someone. Call me old school.

2) Shopped around online: I then filled out my mortgage details on LendingTree Mortgage to see what their bankers could come up with. I like LendingTree because they have one of the largest mortgage lending networks online, and they aggressively compete for your business. Within five minutes of filling out the application, I got several phone calls and e-mails. They are super efficient, so don’t be surprised. I wanted to use LendingTree to make sure Citibank was indeed providing a good rate. Some of the LendingTree-referred bankers said they could match 2.375%, while one said he could do 2.25%, but for a quarter point in cost. It’s not a problem to get a mortgage with an institution that might not have a branch close by. But I prefer having a branch I can walk into and talk to someone. Call me old school.

3) Tracked down my old mortgage officer now at a new bank: Armed with six solid mortgage offers, I then Googled the name of my old Citibank mortgage broker who left to go to JP Morgan Chase. I called him on a Sunday and he surprisingly picked up. I told him I want a 2.25% 5/1 ARM jumbo loan for a cost of under $3, 000. I mentioned my six other bids, and highlighted the collapse in the 10-year yield to 1.85% to get him to accept. He told me he’d look into things because the rate was so low. I knew that bringing over new business would be huge for him, so I filled out a two-page Chase mortgage application. Having an official application would give him more firepower to convince his manager he has a very serious customer. It worked. I was able to get a “no risk” mortgage refinance because his manager agreed to not only accept 2.25% for a 5/1 jumbo ARM, but will also waive the ~$800 appraisal fee if my mortgage refinance were to fail. I have nothing to lose, except for time.

4) Dangled the carrot: As a bonus, I offered to open up a savings, checking, and potentially investment account with the new bank to get them to give me the lowest rate possible. Banks want sticky clients with multiple accounts for cross selling and revenue generation purposes. There is no legal quid pro quo that banks can use to get you better terms. But every big bank has a tiered client system in place where clients with more assets get better access, rates, and benefits. I’m planning on opening up a $25, 000 savings account with Chase as a good gesture. Each savings account is FDIC insured up to $250, 000, so if you happen to have more than $250, 000 saved per individual, you might as well diversify your savings anyway.