Best 5 years fixed rate mortgages

Mongoose vs. Cobra. Coyote vs. Roadrunner. Pirate vs. Ninja? And finally, fixed-rate mortgage vs. adjustable-rate mortgage. Yes, we’re talking about the greatest rivalries of all time.

Mongoose vs. Cobra. Coyote vs. Roadrunner. Pirate vs. Ninja? And finally, fixed-rate mortgage vs. adjustable-rate mortgage. Yes, we’re talking about the greatest rivalries of all time.

So what’s better, the boring old fixed-rate mortgage or the more provocative adjustable-rate mortgage (ARM)?

During the housing boom, homeowners often chose adjustable-rate mortgages as a means to qualify for a home they probably wouldn’t be able to afford with a traditional fixed mortgage.

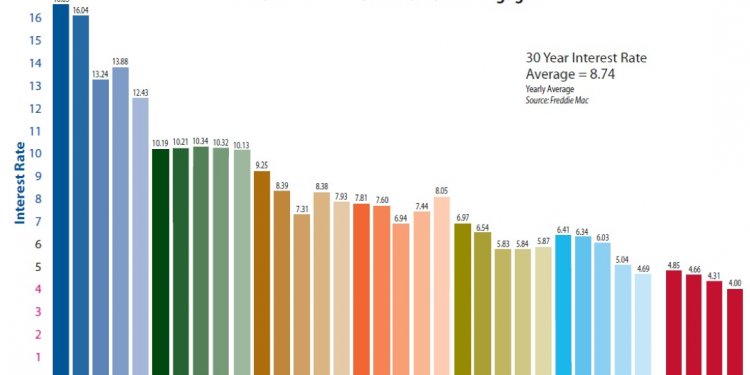

But times have changed, and adjustable-rate mortgages have now fallen out of fashion with fixed-rate mortgage rates hovering near record lows.

In fact, fixed-rate mortgages account for more than 90% of the purchase money mortgages and refinance loans being originated nowadays.

Sure, fixed mortgages are definitely more popular, but that doesn’t mean they’re any better. It’s just a matter of preference for most. And as homes become less and less affordable, the popularity of ARMs will rise once more.

Fixed-Rate Mortgages Are the Default Option

When taking out a mortgage, most people tend to choose a fixed-rate mortgage, making it the default option. The most popular of the fixed mortgages is the 30-year fixed, seeing that the payment is fixed for the entire term of the loan, and the long amortization period keeps monthly payments low.

The 15-year fixed-rate mortgage is also pretty popular, but because the entire balance must be paid off in half the amount of time, monthly payments are much higher. That means fewer borrowers are willing or able to choose one.

Then there are adjustable-rate mortgages, which most borrowers tend to avoid unless they are extremely savvy, or instructed to do so by their broker or loan officer.

I say savvy because some folks will gamble on the initial interest rate discount afforded to ARMs despite the associated risk of a higher interest rate in the future. So you need to know what you’re doing when selecting an ARM.

However, there are also those borrowers who must take out an adjustable-rate mortgage to qualify because the interest rate is lower. Typically, the real estate agent, broker, or loan officer will float the ARM option to the borrower, whether it’s in their best interest or not.

What Type of ARM Are We Talking About?

The big question is what type of adjustable-rate mortgage are we dealing with?

These days, it’s quite common to take out an ARM with a fixed-rate period, such as a 5/1 ARM or a 7/1 ARM. There’s even an option that is fixed for 10 years before its first adjustment.

The above examples are fixed for the first five and seven years, respectively, before becoming annually adjustable. They’re known as hybrid ARMs for that reason.

This means you’ve got some breathing room before the interest rate adjusts up or down. That’s right, your mortgage rate can move up or down if it’s an ARM.