Best 5 years fixed rate home loan

Mortgage loans can be classified and categorized a few different ways. We'll start with how the loans are structured for repayment. Generally speaking, they fall into two categories; Fixed rate and adjustable rate mortgages.

Mortgage loans can be classified and categorized a few different ways. We'll start with how the loans are structured for repayment. Generally speaking, they fall into two categories; Fixed rate and adjustable rate mortgages.

Fixed Rate and Adjustable Mortgages

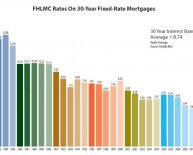

With a fixed rate mortgage, the interest rate remains the same for the entire term of the loan. The most common loan term is 30 years and is referred to as a "30 Year Fixed" mortgage. 15 year terms are also popular and other term lengths can be found ranging from as few as 10 years to as long as 50 years.

The primary advantage of a fixed rate loan is the certainty of knowing your payment amount and knowing that it will not change. The disadvantage is that this certainty comes with a slightly higher interest rates than the alternatives.

These loans are best suited for buyers who plan to stay in their new home for the foreseeable future and who want security of knowing what their payment will be for the length of the loan.

The second category of loans are adjustable rate mortgages, also known as ARM's. As the name implies, the interest rate on these loans is adjusted periodically based on a specified financial index. Commonly used indexes include the London Interbank Offered Rate (LIBOR), the Cost of Funds Index (COFI) or 1-Year Treasury Notes.

These loans typically have a low starting rate therefore lowering your monthly payment compared to a fixed rate mortgage. However, because the rate is tied to an index that fluctuates based on market conditions, there is risk of your monthly payment moving higher should the index move up.

There is also third option called a hybrid. These loans combine elements of both a fixed rate and an adjustable rate mortgage. They start off as a fixed rate for a set number of years and then convert to an adjustable mortgage.

An example of such a loan is a 5-Year ARM or a 5/1 ARM. This means the loan's interest rate is fixed for the first 5 years then it becomes adjustable. The advantage of this loan is that the fixed rate period of the loan usually has a lower interest rate than a 30 Year Fixed mortgage. For buyers who plan to stay in their new home for 5 years or less, this can be a more affordable yet less risky alternative.

Variations on the hybrid loans, such as a 3/1 ARM or 7/1 ARM, alter the length of the fixed part of the loan. In these instances, the fixed period would be 3 years and 7 years respectively.