Mortgage loan processing

You submitted your loan application two weeks ago. But, you have yet to hear back from your lender. You may begin wondering, "What's the hold up?" Well, it could be any number of things. In any case, do not fret. Your loan application will get processed. It just may take a little bit longer than you had initially expected.

You submitted your loan application two weeks ago. But, you have yet to hear back from your lender. You may begin wondering, "What's the hold up?" Well, it could be any number of things. In any case, do not fret. Your loan application will get processed. It just may take a little bit longer than you had initially expected.

To help you better understand how the loan process becomes delayed, here's a quick list of few common bottlenecks lenders face.

Internal Coordination

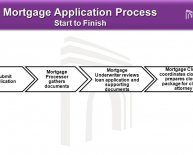

During loan processing, your application will pass through the hands of 20 mortgage professionals, at least! And with so many people handling your application, it's easy for processing to get backlogged. Remember, your file must be checked by the processing team, the underwriting team, and the settlement team – in that order. That's a lot to coordinate!

Influx of Loan Applications

With interest rates near record lows, you may be considering locking in some new mortgage terms. But, you're not the only one with that thought. When rates drop, volume goes up. This could certainly equate to a longer processing time for your mortgage application.

Obtaining Verification

Processing is most commonly delayed by document verification. Remember, lenders need to fully assess a borrower's risk before choosing to approve or deny a loan request. Among others, this means verifying employment with managers, obtaining mortgage history from credit bureaus, and acquiring rental records from previous landlords. Confirming this information can take time - especially if your references are difficult to contact or less than cooperative.

Doing More with Less

As a result of the subprime mortgage crisis, lenders are now subject to stricter lending standards. Re-examinations and verifications of all applicant documentation are a necessity. Employees must adhere to the robust guidelines and accommodate the ever-growing list of compliance checks, extending the processing timeline.

Speeding Up Processing: Some Helpful Tips

Never fear. There are a few steps you can take to help simplify the job of your lender and speed up that loan process.