Mortgage loan Processing Procedures

Buying a home may be the most exciting, confusing and stressful financial transaction you will ever undertake. Even if you have done it several times you can still find the process complicated and intimidating, particularly given all the new regulatory and compliance rules surrounding the mortgage process. If you understand the steps required to qualify for a mortgage loan much of the stress can be avoided. The following explanation of the loan application process is intended to help you through the complexities of obtaining a mortgage loan.

Buying a home may be the most exciting, confusing and stressful financial transaction you will ever undertake. Even if you have done it several times you can still find the process complicated and intimidating, particularly given all the new regulatory and compliance rules surrounding the mortgage process. If you understand the steps required to qualify for a mortgage loan much of the stress can be avoided. The following explanation of the loan application process is intended to help you through the complexities of obtaining a mortgage loan.

Additional Information that May be Required

You will be asked to sign a section of the loan application form that contains your certification that the information you have provided is correct to the best of your knowledge, your promise to advise the lender of any material changes in the information; and your consent to (1) verification of the application data (2) submission of the account history to credit reporting agencies and (3) transfer of the loan or servicing to successors to the original lender.

The last part of the application requests information on the race, ethnicity and gender of the applicants. The Federal Government uses this information to monitor lenders compliance with fair housing and ECOA laws. Providing this information is strictly voluntary on your part and has no effect on your loan application. We are required however by federal law to request this information.

Appraisal Information

Because the property is security for the loan, C&F will order an appraisal on your property and comply with the Appraisal Independence Requirements.

This regulation requires strict adherence to appraisal independence safeguards and standards. You are entitled to receive a copy of your property appraisal report no later than three business days prior to closing of your mortgage loan transaction. You will sign a disclosure form at the time of application outlining the two options regarding timing of receipt of the appraisal report. The appraisal is typically ordered shortly after your application and you will be charged the fee for this service if the appraisal cost has been incurred.

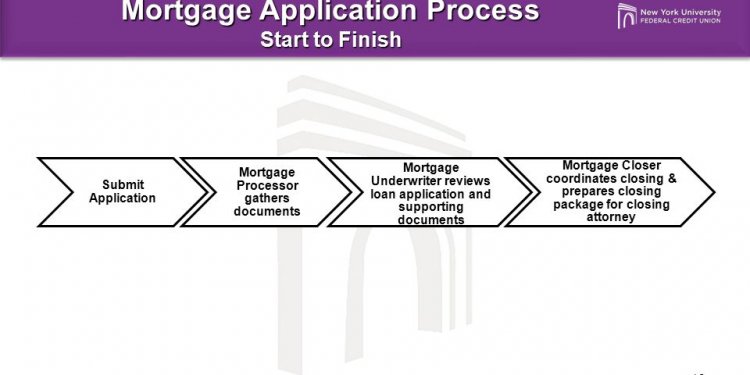

After the Loan application - What is Next?

After the loan application has been completed it will be turned over to the loan processor to complete validation of the above information and thereafter to the loan underwriter for a decision. The loan processor will validate the employment and asset information, order the credit report, property appraisal and other documents. The time it takes to receive these documents affects the length of time required for approval of the loan so the more information you provide upfront will help speed this process up. Your C&F Loan Officer will be able to give you an idea of the processing time for your loan application.

Within three business days after completing the application, C&F will provide a Good Faith Estimate of the anticipated closing costs and a Truth in Lending Statement. The Good Faith Estimate of Closing Costs (GFE) provides an estimate of your settlement charges and loan terms. The Truth in Lending statement shows, among other things, the estimated monthly payment and the total of all finance charges on your loan, stated as an annual percentage rate (APR). The APR represents the dollar amount of the finance charges you pay either up front or over the life of the loan converted to an annual interest rate. Since the APR includes origination fees and other charges as well as interest on the mortgage loan, the APR is usually higher than the interest rate on the loan.

Closing

Once the loan application is approved, the necessary documents will be prepared for closing the transaction. C&F closing department will work closely with the loan officer and the closing agent to ensure all conditions of the loan approval are met and a convenient time is scheduled for you to sign the loan documentation with the closing agent.

At the closing:

- Please bring valid identification

- Review your final application to ensure the interest rate and loan terms are what you agreed

- Confirm the information on the final application is true and correct – Do not proceed with the closing if information is inaccurate or has changed

- Be prepared to bring a cashier’s check for your down payment and closing costs

After Your Closing

Please contact your C&F representative if you have any issues or concerns after closing - we appreciate your feedback and your complete satisfaction is very important to us.

How can I reduce the anxiety of the loan process?

- Keep the lines of communication open with your loan officer - it may take several weeks to process the application

- Please respond quickly if C&F needs additional information or documents during the process – an immediate response to our requests helps keep the closing on schedule

- Mortgage loans today require much more paperwork and legal documentation than in the past and we do not ask for more than is absolutely necessary.

- Advise your loan officer immediately of any change in your financial profile: job change, additional debts, credit inquiries, etc. Do not sign the final closing documents if your financial profile has changed – serious consequences may result as outlined in the documents you signed during the loan process.