Lowest 30 Year fixed mortgage Rates Today

“Continuing fallout from the Brexit vote drove Treasury yields lower again this week, ” Sean Becketti, chief economist for Freddie Mac, said in a release. “The 30-year fixed-rate mortgage followed Treasury yields, falling seven basis points to 3.41% in this week’s survey. Mortgage rates have now dropped 15 basis points over the past two weeks, leaving them only 10 basis points above the all-time low.”

“Continuing fallout from the Brexit vote drove Treasury yields lower again this week, ” Sean Becketti, chief economist for Freddie Mac, said in a release. “The 30-year fixed-rate mortgage followed Treasury yields, falling seven basis points to 3.41% in this week’s survey. Mortgage rates have now dropped 15 basis points over the past two weeks, leaving them only 10 basis points above the all-time low.”

As a result, home loan volume is soaring. The Mortgage Bankers Association reports mortgage applications rose 14.2% over the previous week, in a survey ending July 1.

“Interest rates continued to drop last week as markets assessed the impact of Brexit, downgrading the likelihood of additional rate hikes by the Fed, and mortgage rates for 30-year conforming loans dropped to their lowest level in over three years, ” Mike Fratantoni, the MBA’s chief economist, said in a statement. “In response, refinance application volume jumped almost 21% last week to its highest level since January 2015.”

The NerdWallet Mortgage Rate Index compiles annual percentage rates — lender interest rates plus fees, the most accurate way for consumers to compare rates. Here are today’s average rates for the most popular loan terms:

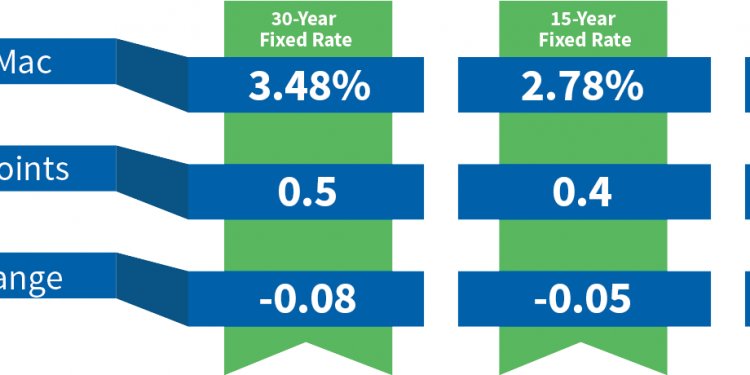

(Change from 7/6)

30-year fixed: 3.51% APR (-0.01)

15-year fixed: 2.96% APR (+0.01)

5/1 ARM: 3.33% APR (+0.02)

30-year fixed: 3.61% APR (+0.01)

15-year fixed: 2.98% APR (+0.02)

5/1 ARM: 3.35% APR (+0.02)

Wells Fargo, Chase and BOA mortgage rates

Three major components of the NerdWallet Mortgage Rate Index are leading lenders Wells Fargo, Chase and Bank of America. Their current purchase mortgage rates are:

NerdWallet daily mortgage rates are an average of the lowest published APR for each loan term offered by a sampling of major national lenders. Annual percentage rate quotes reflect an interest rate plus points, fees and other expenses, providing the most accurate view of the costs a borrower might pay.More from NerdWallet

Compare online mortgage refinance lenders

See also:

- norwich terrier puppy with International Delivery