Lowest 5 Year mortgage rates

By Ellen Chang |

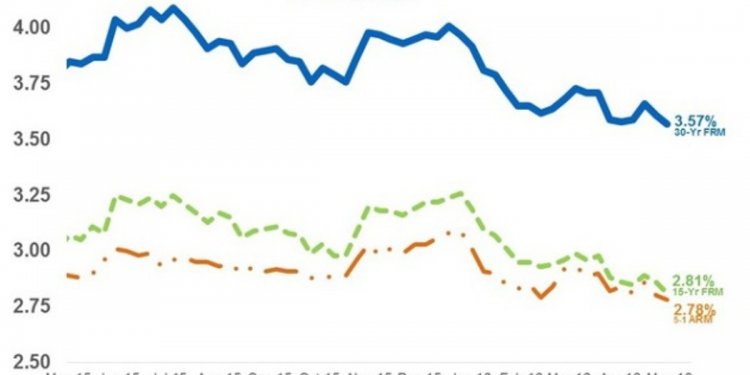

U.S. mortgage rates have remained low in the aftermath of the Brexit vote, declining Treasury rates and a stagnant economy, giving potential homeowners an opportunity to save money. Potential homeowners in the U.S. can take advantage of the continuation of cheaper mortgage rates since the Federal Reserve has not increased interest rates. But, how do you snag the absolute lowest rates for a traditional 30-year fixed rate mortgage, especially if you are a first-time homebuyer? How to Get a Low Rate Low mortgage rates can play a large factor in homeowners' ability to save tens of thousands of dollars in interest. Even a 1% difference in the mortgage rate can save a homeowner $40, 000 over 30 years for a mortgage valued at $200, 000. Having a top notch credit score plays a critical factor in determining what interest rate lenders will offer consumers, but other issues such as the amount of your down payment also impact it. A high credit score is the key to ensuring that borrowers receive a low mortgage rate. Here's a quick rundown of what the numbers mean - a score of anything below 620 ranks as poor, 620 to 699 is fair, 700 to 749 is good and anything over 750 is excellent. Think carefully before canceling a credit card with a long, positive history, but decrease your debt. One of the biggest factors which impacts your credit score is your credit utilization rate. Many potential homeowners focus only on the interest rate or the monthly payment. The APR or annual percentage rate gives you a better idea of the true cost of borrowing money, which includes all the fees and points for the loan. The origination fee or points are charged by a lender to process a loan. This fee shows up on your good faith estimate (GFE) as one item called the origination charge. However, the origination fee can be made up of a few different fees such as: processing fees, underwriting fees and an origination charge. Homeowners who are able to afford a 20% down payment do not have to pay private mortgage insurance (PMI), which costs another 0.5% to 1.0% and can tack on more money each month. Having at least 20% in equity shows lenders that there is a lower chance of the individual defaulting on the loan. Here are the top five lowest rates for a 30-year mortgage, according to RateWatch, a Fort Atkinson, Wis.-based premier banking data and analytics service owned by TheStreet, Inc., which surveyed the majority of institutions in the U.S. from October 3 to October 10.