Different Home Loans

About two years ago, my husband and I were in the process of looking for a new home. Thankfully, after a painful nine-month search (yes, it was painful to compromise on some things), we were able to find the right home for us.

About two years ago, my husband and I were in the process of looking for a new home. Thankfully, after a painful nine-month search (yes, it was painful to compromise on some things), we were able to find the right home for us.

Well, as the saying goes, “Want to make God laugh? Tell him about your plans!” Just a little over a year after moving into our house, our plans have taken a pretty interesting turn. My husband has accepted a job in a different state and we’re relocating!

So, after about one and a half years of living in our home, we decided to put it up for sale. Luckily, we were under contract to sell our house (had an offer, and accepted it) about four days after we listed it. Want to know what I think helped us sell it faster? I think the fact that it was in a good location, close to everything, including good schools, helped. Also, our agent hired a professional photographer to take pictures and video for the online listing. Plus, we tried to keep the house as clean and clutter-free as possible (believe me, with a 6 year-old and 15 month-old, this was the hardest part.)

I have faith that we’ll find the right home in the new state, just like we did before. But, it does take a lot of time, number-crunching and negotiating… which is the last thing you want to do after a long day at work and raising young children.

If you’re in a similar situation or are considering moving out of state, check out some of the stuff we’ve learned so far. I hope you find our experiences helpful during this crazy, but exciting, time.

Find the right real estate agent

First, if you have friends or family in the new place, ask them to refer you to a real estate agent they trust. If you don’t know anyone there and have already found a job in the new city, ask your new co-workers for referrals. In our case, the relocation company helping with our move assigned us one.

Also, make sure you ask about availability and how much notice you have to give before you make a house-hunting trip. This last factor was very important for us, since we knew we weren’t going to be able to make a lot of house-hunting trips before the final move. In fact, we actually decided to switch agents to one that was more flexible and accommodating with our crazy schedules.

Get reports, maps, guides, etc. to help you narrow down neighborhoods

Second, ask your new real estate agent to provide school reports, maps and any other information that can help you narrow down the neighborhoods you’re interested in. A lot of times, real estate agents, especially those who specialize in relocation, have access to guides made specifically for those moving from out of state or out of the country.

Work with a lender that specializes in Relocation or out-of-state purchases

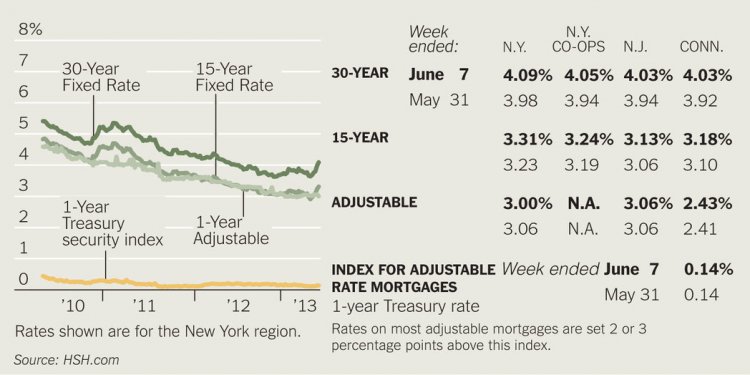

While you’re narrowing down the areas you’re interested in, it’s also a good idea to get preapproved for a mortgage with a lender that is familiar with Relocation loans or with real estate transactions in the state you’re interested in. This way, you’ll get a much better idea of how much home you can afford.

Find out if your ideal neighborhoods are within your budget

Once you’ve narrowed down the neighborhoods, do a quick search online for these areas to get an idea of price ranges. Or, you could always just ask your agent to send you active listings in these areas. Either way, you have to find out if these communities are within your budget. Not only look at prices, but also into HOA, CDD or any other types of fees that may increase your housing monthly payments significantly.

Schedule your house-hunting trip

Next, schedule your house-hunting trip and notify your agent. In our situation, we made sure we gave as much notice as possible so that our agent could start talking to builders of possible inventory homes (we decided we wanted to try to get a newly-built home) and possible deals and incentives. If you’re looking at resale homes, your agent will be able to see what’s available out there and try to schedule appointments to view homes. Even if your trip is several weeks away, you may still want your agent to send you new listings… you never know, you may see a home that you like and it may still be available when you get there.

Come up with a detailed plan for your house-hunting trip

About two days before your house-hunting trip, get in touch with your agent and ask if they have an itinerary or plan for when you’re there. On our first trip, which was only two days long, our agent had arranged separate folders for each day, including listing and builder information… in the order we were going to see them! Yes, I was very impressed with her organization skills, AND grateful, to say the least.

Don’t forget to take notes!

While you’re house-hunting, take notes! We had so many houses we wanted to see that I didn’t even get a chance to take many notes, which I regret. You want to be able to revisit your notes after taking a break. It helps keep your mind clear. After a while, all the houses seem to blend together.

Use pictures, video and video chat with those helping you make the decision

Now, let’s say that you’re shopping for a home with a significant other but your “other” may not be able to travel with you. Ask your significant other to take pictures, videos or just do video chat, so you can see as much of the home as possible from far away. This has been a huge help for me and my husband, since he’s already working in the new city and is able to go look at homes after work.

So, there you have a few tips to help you during your out-of-state home search. Even though relocating is a stressful time, with some planning and organization, you may be able to make this a more manageable move.