Obama Home Loans

We learned nothing from the last financial crisis. The housing market is set to collapse, again, and a key culprit, again, is artificial demand created by government policies.

We learned nothing from the last financial crisis. The housing market is set to collapse, again, and a key culprit, again, is artificial demand created by government policies.

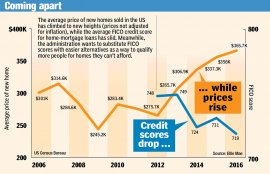

For starters, mortgage-software firm Ellie Mae reports that the average FICO credit score of an approved home loan plunged to 719 in January (the latest month for which data is available) from 731 a year earlier, and well below 2011’s peak of 750.

It’s a dangerous sign lenders are loosening underwriting standards. Lower FICO scores correlate with higher risk of loan default.

The Federal Housing Administration is a big reason for falling credit scores. So are Fannie Mae and Freddie Mac. The government housing agencies have slashed credit requirements under pressure from the Obama administration — like the Clinton administration before it — to qualify more immigrants and minorities with low incomes and “less-than-perfect credit.”

Meanwhile, home lenders are approving more debt-strapped borrowers. According to Ellie Mae, applicants approved for mortgages in January had an average household debt-to-income ratio of 39%, up from 2012’s annual average of 34%. Borrower debt loads have been creeping higher each year since 2012, when Ellie Mae first started tracking such data.

Flip and flop

A recent report by the Office of the Comptroller of the Currency, a federal agency that regulates the nation’s banks, warns that declines in mortgage underwriting standards are mirroring pre-crisis trends.

“Underwriting standards eased at a significant number of banks for the three-year period from 2013 through 2015, ” the report said. “This trend reflects broad trends similar to those experienced from 2005 through 2007, before the most recent financial crisis.”

Not since 2006, it noted, have lenders taken on so much credit risk, and it says the hazard will continue to grow this year: “Examiners expect the level of credit risk to increase over the next 12 months.”

A large chunk of the risk is coming from first-time home buyers with shaky credit and so-called “rebound” buyers who previously defaulted on home loans.

A large chunk of the risk is coming from first-time home buyers with shaky credit and so-called “rebound” buyers who previously defaulted on home loans.

In the interest of ‘fairness, ’ Obama is lowering credit standards for mortgages — recreating the conditions that brought down the economy in 2008.

The American Enterprise Institute reports that its National Mortgage Risk Index for first-time buyers jumped almost a full percentage point in January from a year earlier, driven by “loose credit standards.” The demand from otherwise uncreditworthy home buyers “is driving home prices up faster than incomes and inflation, ” noted Edward Pinto, co-director of AEI’s International Center on Housing Risk in Washington.

This is especially true in hot spots like California, where subprime-mortgage lenders offering interest-only loans with no FICO-score requirements are cropping up from the ashes of Countrywide Financial, the bankrupt Calabasas, Calif.-based subprime giant.

In another sign housing is overheating, home “flipping” is red hot again and hitting levels not seen since just prior to the mortgage meltdown. Nationwide, almost 180, 000 homes were sold and then resold last year — the highest level since 2007.

In fact, according to RealtyTrac, flipping in a dozen metro areas — including New York, Los Angeles, San Diego, Miami and Jacksonville, Fla. — exceeded peaks set in 2005, when investors took advantage of low interest rates and easy credit.

Analysts warn sales from home flipping artificially inflate home prices, increasing the risk of a housing bubble.

“When home-flipping numbers go up, it is usually an indication that the housing market is in trouble, ” said Matthew Gardner, chief economist at Windermere Real Estate in Seattle.

What goes up…

What goes up…

The last housing bubble began inflating in 1997 and lasted 10 years before finally bursting in 2007, in a monumental collapse that crashed markets the world over.

Analysts say the current real-estate bubble started in late 2011, when housing values bottomed. Since then, real median home prices have rebounded to a level that is only about 8% below their pre-crisis peak, which was an all-time record.

Like the last bubble, this one is fueled by artificial demand from government-induced lax lending standards and accommodative interest rates set by the Federal Reserve.

“The result has been a rapid increase in real, inflation-adjusted home prices, with prices up nationally about 16.5% since the home-price trough in 2012, ” Pinto said.

He notes that once prices hit 20% or higher, historically, a painful drop in prices follows.

“Home prices are subject to the law of gravity, ” he said. “What goes up must come down.”

Pinto noted that prices for entry-level homes have climbed by an even higher 19%, making it harder for low-income borrowers to buy without taking out a high-risk loan they really can’t afford.

When home-flipping numbers go up, it is usually an indication that the housing market is in trouble.

- Chief economist at Windermere Real EstateYet these kinds of borrowers are qualifying for such home loans thanks to the liberalization of credit terms. New federal rules regulating mortgages under President Obama’s “financial reforms, ” despite claims of toughness, are not limiting the volume of high debt-to-income loans. While the rules do recommend a DTI ceiling, they never set minimum down-payment or credit-score requirements.

Today’s relaxation in mortgage-underwriting standards is largely a function of government housing-policy changes at FHA, Fannie Mae and Freddie Mac, which dominate the nation’s mortgage activity.

As in the last easy-credit cycle, we are seeing “the promotion of policy to push firms to seek riskier products to promote growth, ” Wells Fargo Chief Economist John Silvia said.

All three agencies have slashed down-payment and other requirements under pressure from Obama regulators, who include, most significantly, former Congressional Black Caucus leader and Obama appointee Mel Watt, head of the new Federal Housing Finance Agency, which now controls Fannie Mae and Freddie Mac.

Not ‘homeready’

Last year, Fannie Mae launched a new subprime-mortgage product called HomeReady that caters to recent immigrants with weak credit and limited income.

The new loan program, which offers “income flexibility, ” allows borrowers for the first time to bundle income from roommates and relatives to meet qualifications for income. They only have to put 3% down, and can use gifts from nonprofit groups to subsidize their down payments.

“There is no limit on the number of non-borrower household members who can be present on a single transaction, ” Fannie advises originators. And even then there is “documentation flexibility, ” a frightening echo of last decade’s “no-doc loans.”

At least before the crisis, your income had to be your own. But now, as a renter, you can get a conventional home loan backed by Fannie by claiming other people’s income. All you have to do in exchange is take a four-hour online course on the responsibilities of homeownership.