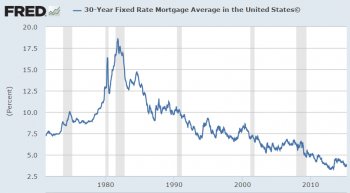

Thirty Year fixed rate mortgage

I said that today’s roughly 3.5% mortgage rates are going to look silly someday so not all of the low interest rate policies have hurt savers that can take advantage. If you’re able to lock in low interest rates you can also lock in future savings for many years to come. This chart led to a discussion about the pros and cons of a 30 year fixed rate mortgage since many countries do things much differently than the U.S.

I said that today’s roughly 3.5% mortgage rates are going to look silly someday so not all of the low interest rate policies have hurt savers that can take advantage. If you’re able to lock in low interest rates you can also lock in future savings for many years to come. This chart led to a discussion about the pros and cons of a 30 year fixed rate mortgage since many countries do things much differently than the U.S.

Pros:

- You can plan ahead for the future. You know exactly what your payment will be every single month. During the real estate bust, many that went with adjustable rate mortgages didn’t plan on a reset to higher rates and it cost them.

- A mortgage works like a callable bond, so you’re able to refinance to a lower interest rate if they should fall.

- If interest rates rise, you still get to pay the lower than market interest rate.

- By spreading a loan over a 30 year period, you’re able to make a large purchase that you wouldn’t normally be able to make.

- You can write off the mortgage interest for a tax break.

- You can pay off the loan early to decrease overall interest charges.

Cons:

- Refinancing isn’t free as you have to pay closing costs and each time you re-fi it resets the term of the loan. As rates have fallen drastically over the past thirty years, locking in fixed rates would have meant constantly refinancing and incurring closing costs to take advantage of the new lower rates.

- If you don’t pay off your mortgage early you end up paying a huge amount in interest costs over the term of the loan. The median home price in the U.S. is roughly $200, 000. Over 30 years at a 3.5% fixed rate mortgage you’ll end up paying almost $125, 000 in interest over the course of the loan. At a 6% mortgage rate, the total interest cost comes to more than $231, 000, more than the actual mortgage itself.

- The majority of the interest costs come in the early years of a loan so it takes time to build equity in your home. Roughly 30% of interest costs are paid in the first 5 years of a 30 year loan.

The last item on the cons list really matters for those who don’t stay in their house long enough to build equity by moving around or trying to move up to a new house in a short period of time. Ryan Harvey shared with me a blog post he wrote a few years ago that detailed the other costs that come into play with homeownership above and beyond the initial interest payments. Here’s Ryan:

This is one of the reasons I’ve always been against buying a starter home when you’re young. It’s going to be nearly impossible to build equity in your home on a net basis after accounting for all costs if you try to jump from house to house in short order.

Young people think they’re throwing money away when they rent because your “paying someone else’s mortgage.” What most don’t consider is the total expenses that come into play from homeownership, including the costs of a mortgage and all of the incidentals in the first few years.

A 30 year fixed rate mortgage isn’t perfect. It’s possible interest rates could continue to fall. Mortgage rates are already near zero in some European countries. If you don’t pay off your mortgage early you’ll end up paying the bulk of your mortgage in interest rate costs. If you move after just a few years you’ll almost certainly lose money on the purchase and sale.

The problem with all of this is that a home is perhaps the most emotional purchases most people will make in their lifetime. This is why so many people run into financial ruin because of a poor real estate decision. I’m not sure many people take into account mortgage rates when looking to purchase a home for themselves and their family. A home offers a kind of psychic income that’s difficult to quantify. Few people consider spreadsheets when purchasing a home.

But for those that plan on staying in one place for a number of years, would like to have some certainty from a financial planning perspective and understand the dynamics of the real estate market, locking in an interest rate in the 3-4% range will probably look like a pretty good deal in the future.