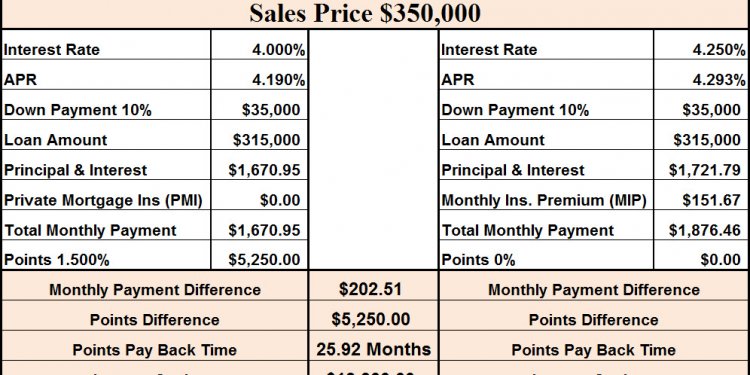

Fixed Rates mortgage comparison

This calculator that will help you to compare monthly payments and interest costs of home mortgages at various loan term lengths.

This calculator that will help you to compare monthly payments and interest costs of home mortgages at various loan term lengths.

Shorter mortgages generally come with higher payments, but they also have lower interest rates & cost far less in interest due to the loan having a much shorter duration. This infographic compares the advantages of 15 year mortgages over 30 year mortgages.

(Almost) Everything You Should Know About Mortgage Rates

Buying a house is one of the biggest and most important decisions that a person can make in their lives. For the majority of Americans, a mortgage is the only option they have to their first home or any subsequent homes afterwards. To mortgage a house, banks often require down payments that are around 10% of the total amount depending on your credit score, ability to repay and other important factors.The information below consists of the difference between fixed and adjustable rate mortgages, what mortgage rates are indexed to, the benefits and downsides to long or short term mortgages, how to prepare your finances to buy a home, how to successfully afford your mortgage, how often people move and have to switch mortgage terms around, incentives for buying, risks associated with home ownership and trivia facts that are focused on home mortgages.

Fixed Rate vs Adjustable Rate

With any loan the two most popular terms that people will hear are fixed rate and adjustable rate. Mortgages are not much different from other loans in this aspect. Fixed rate mortgages allow the buyer to have one interest rate throughout the entire term of their mortgage. The rate does not change ever and will often be somewhat higher than an adjustable rate mortgage. With adjustable rate mortgages your rates will fluctuate depending on the economy and where you are at in the life of your mortgage. These rates often start out much lower than a fixed rate mortgage but can go up months or years after the mortgage loan starts. Both of these types carry their own benefits and disadvantages. It is important that remember a few key points when you decide whether you want a fixed rate mortgage or an adjustable rate mortgage.