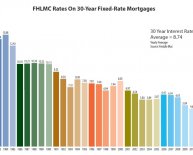

Current 30 Year Conventional Mortgage Rates

As we head into the holiday weekend, mortgage interest rates seem to be staying fairly consistent, rising only.06% over last week.

As we head into the holiday weekend, mortgage interest rates seem to be staying fairly consistent, rising only.06% over last week.

Said Sean Becketti, Chief Economist for Freddie Mac:

“Overseas events are generating significant day-to-day volatility in interest rates. Nonetheless, the week-to-week impact on most rates was modest — the 30-year mortgage rate increased just 6 bps, to 4.08 percent. The MBA composite index of mortgage applications fell 4.7 percent in response to what is now three consecutive weeks of mortgage rates over 4 percent. Other measures, however, confirmed continued strength in housing — pending home sales rose 0.9 percent, exceeding expectations, and the Case-Shiller house price index recorded another solid increase.”

| 30-Year Fixed Rate | 15-Year Fixed Rate | 5-Year ARM | |

| Freddie Mac PMMS¹ | 4.08% | 3.24% | 2.99% |

| Fees & Points |

What does this mean for you?

It might seem like these changes aren’t that big of a deal, but they’re part of a trend. 59% of experts polled by Bankrate expect interest rates to keep rising in the coming weeks. So, as we’ve been saying for months at this point, if you’re thinking about applying for a mortgage or locking in a rate, it’s probably best to do it sooner than later.

Our Current Rates:

| Rate | 3.750% | 2.875% | 2.375% |

| 2.0 | |||

| APR | 3.937% | 3.203% | 3.020% |

*Rates accurate as of 7/2/15. See below for assumptions.

Rate Assumptions

Mortgage rates are volatile and are subject to change without notice. All rates shown are for 30-day rate locks for an owner-occupied primary residence unless otherwise noted.

Extended locks are available; prices will vary accordingly.

The APR for 30-year conventional fixed-rate mortgage loan amounts is calculated using a loan amount of $417, 000, 2 points, a $495 application fee, $799 underwriting fee.*

The APR for 15- year conventional fixed-rate mortgage loan amounts is calculated using a loan amount of $417, 000, 2 points, a $495 application fee, $799 underwriting fee. 15-year conventional mortgage rates are calculated with a 15-year loan term.*

The APR for adjustable rate mortgages (ARMs) is calculated using a loan amount of $417, 000, 2 points, a $495 application fee, $799 underwriting fee. Some rates and fees may vary by state.*

Products are subject to availability on a state-by-state basis. All interest rates listed are for qualified applicants with 740 or higher FICO and 80 LTV over a 30-year loan term except where otherwise noted and are subject to mortgage approval with full documentation of income.