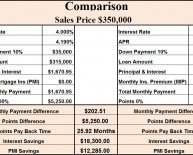

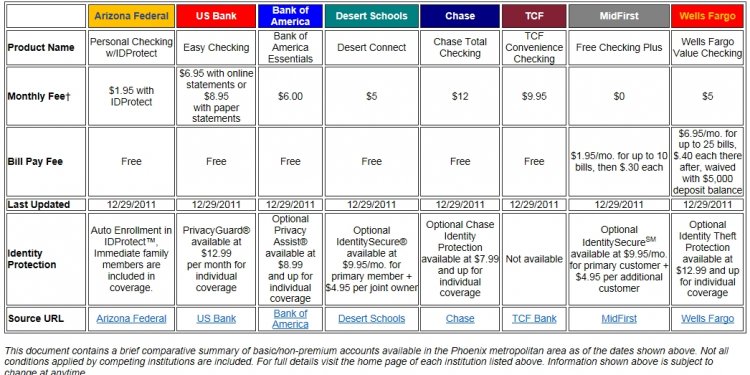

Mortgage rates Comparison Chart

Mortgage Calculator

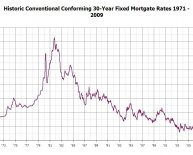

Fixed Rate Mortgage

With a fixed rate mortgage, your interest rate will remain the same over the life of mortgage (i.e. 5, 10, 15, 20, 25, 30 or 40 years). The interest rate is usually higher than other types of mortgages because the lender has more risk if the interest rates increase during the term of your mortgage. For this reason, the lender has a little cushion built into the fixed rate mortgage. The mortgage payment will remain the same from the first payment to the last payment. The fixed rate mortgage is the most conservative payment plan.

Fixed Rate Comparison Calculator

Adjustable Rate Mortgage

As the name implies, the mortgage interest rate will “adjust”. Adjustable rate mortgages are also called “variable rate mortgages”. There are several varieties of adjustable rate mortgages. For example, the interest rate on the one year adjustable (1 year ARM) rate mortgage will adjust or change every 12 months. The interest rate can go up or down or even remain the same. Another type of adjustable rate mortgage is the hybrid mortgage. This adjustable rate mortgage has a fixed rate of 3, 5, 7 or 10 years and then converts to a one year adjustable. The advantage of this mortgage is a stable, known monthly payment that is fixed for a certain term (i.e. 3, 5, 7 or 10 years) before the interest rate is subject to change. The interest rate on adjustable rate mortgages are usually lower than the fixed rate mortgage

Balloon Mortgage

A balloon mortgage is a home loan with a monthly payment for a specific number of years, usually five or seven years and then the loan balance is due in full. When the "balloons", the borrower must refinance the mortgage balance or refinance the loan.

Bi monthly Mortgage

The bi monthly mortgage is a loan that requires one half of the monthly mortgage payment to be paid twice a month. A loan payment paid in two installments lowers the overall interest paid to the lender.

Bi weekly Mortgage

A bi weekly mortgage is one half of the loan payment paid every two weeks. For example, if your monthly payment is $500 per month, your 12 payments equal $6, 000 ( 12 weeks X $500 = $6, 000 ). The bi weekly payment arrangement results in 26 payments ( 26 weeks X $250 = $6, 500 ) per year. The extra money each year pays off the mortgage faster.