Mortgage Rates NY

NOTE: MortgageLoan.com cannot guarantee the accuracy of the data provided since it is submitted by our visitors.

ARMs

Adjustable-rate mortgages (ARMs) begin with a low, fixed interest rate that converts to a variable rate after a certain period of time. Since the initial rate usually lasts for one, three, or five years, ARMs can be appropriate for New York borrowers who expect an income increase over time. ARMs might also work for borrowers who have seasonal income fluctuations, or homeowners who intend to sell their properties in the short-term.

Home Equity Loans

Second mortgages with a fixed rate of interest are called home equity loans. Home equity loan rates are usually higher than first mortgage interest rates. Still, there are situations where a home equity loan makes more sense than a refinance mortgage. These include:

- If you have a low-rate first mortgage.

- If you don't want to incur the higher closing costs of a refinance.

- If you want to pay off the home equity loan in less than 30 years.

Evaluating

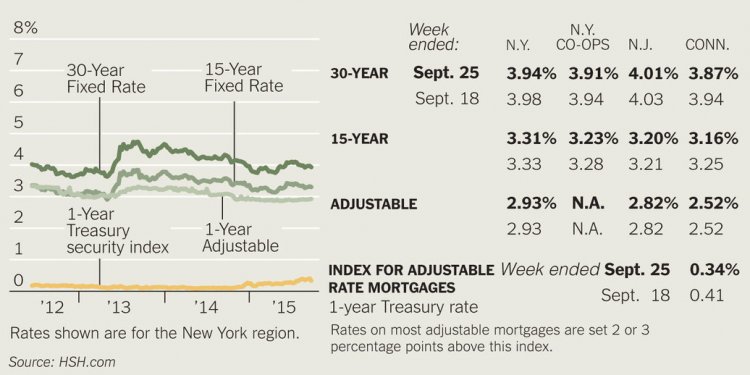

Start your evaluation by developing an understanding of how different loan types compare, rate-wise. When you know, for example, that 15-year fixed-rate mortgages (FRMs) in New York have lower rates than 30-year FRMs, you might decide to refinance your existing loan with a 15-year program. You can then use our mortgage calculators to estimate the payments for different loan types. Mortgage calculators are the risk-free way to experiment with different loan amounts, as well. As you work through this process, think about which loan types are most suitable for your situation. If you plan to remodel, budget for a higher loan amount. If you plan to sell in a few years, run the numbers on an ARM.

With a firm understanding of your budget, and a newfound fluency in the language of mortgage loans, you're ready to select a few brokers from our New York broker directory. Make a point to consult with several lenders and submit several loan applications-it's the best way to land the lowest rate mortgage available.