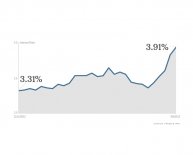

Mortgage Rates in NY

New York: Learning the Layout

New York state encompasses an area of 54, 555 square miles (141, 299 kilometers) with a population numbering around 20, 000, 000 in 2009. Albany is the capitol, with a population of about 94, 000 in 2006. New York City is the most populated, famous and important city measuring an area of about 368 square miles (953 square kilometers) with a population in the range of around 8, 000, 000 for 2009.

Lake Champlain, the Hudson River and Atlantic Ocean form the Eastern border of New York state with the Western border lined by Lake Erie, Lake Ontario and the Saint Lawrence River. The Adirondack and Catskill Mountains run through the East-Central area of the state.

New York Real Estate Prices Compared to Median United States Prices

Due to its location on the Eastern United States coastline, New York was settled before most of the rest of the country. Thus, average New York mortgage rates are priced higher than the average mortgage for the rest of the United States. New York includes some of the wealthiest communiites in the world; Manhattan property is a bellwether for real estate prices around the world.

New York state real estate prices will vary dramatically around the state. The general trends for the last two decades in New York are as follows -

- From 1992 to 1998: generally flat

- From 1999 to 2003: gradually increasing to peak

- From 2003 to 2006: generally flat

- From 2006 to present: starting to fall dramatically

Specific price comparisons between New York and the United States for 2007 to 2009 are as follows according to "InvestmentTools.com":

The following lists New York City average house prices from 2007 to 2009 according to Zillow.com:

- For 2007, the average New York City house price was $450, 000

- For 2008, the average New York City house price was $430, 000

- For 2009, the average New York City house price was $380, 000

According to these Zillow.com charts, New York City average house prices were about $190, 000 more than the United States median house price. For this same period, 2007 to 2009, average New York state house prices ranged from about $260, 000 to $300, 000.

Most Popular and Fastest Growing New York Cities

The New York City Long Island metropolitan area is referred to as Downstate New York, with the rest of the state comprising Upstate New York. Manhattan is just to the west of Long Island and includes some of the most expensive real estate in the world.

Due to its large size, New York City includes many neighborhoods, called boroughs, that have developed their own unique characteristics and have mortgages amongst the highest in the world: including Battery Park, Bedford, Belle Harbor, Carnegie Hill, Central Park, Chelsea, Forest Hill Gardens, Greenwich Village, Little Italy, Manhattan Beach, Queens, SoHo and Sutton Place. Sometimes, New York real estate agents might refer to the county the property is located in (i.e. Nassau or Westchester).

Other popular New York cities include Buffalo, Rochester and White Plains. Buffalo is on Lake Erie in the West; it had a 2006 population of about 276, 000. Rochester is on Lake Ontario in the north-central section of the state. It had a 2006 population of about 211, 000.

Some consider White Plains a suburb of New York City, since it is only about thirty miles northeast of Manhattan. White Plains had a 2006 population of about 57, 000, experiencing a 7.5% increase from 2000. BusinessWeek considers White Plains to be the fastest growing city in New York state for 2010.

Typical New York Mortgages Available

The primary mortgage loans offered in New York are the 15-year fixed rate, 30-year fixed rate and 5/1 adjustable-rate mortgage (ARM). Mortgage loans can be used for purchasing a home, getting a home equity loan (for remodelling) and refinancing a home. In New York, fixed rate second mortgages are called home equity loans; the rates are usually higher than first mortgage rates.