Lower interest rate mortgage

Points, also known as “discount points, ” are fees paid directly to the lender at closing in exchange for a reduced interest rate. This is also called “buying down the rate, ” which can, in turn, lower your monthly mortgage payments.

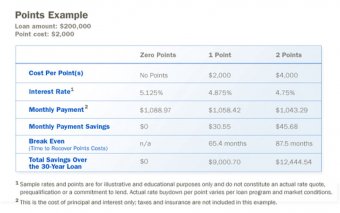

A point is equal to 1% of your mortgage amount (or $1, 000 for every $100, 000). You’re essentially paying some interest up front in exchange for a lower interest rate over the life of your loan.The general rule is that the longer you plan to own the home, the more you might benefit from buying points, because you would realize more interest savings over the life of the loan. When you consider whether points will be right for you, it helps to run the numbers. Here’s an example:

Breaking even

An important thing to consider is how long it will take for the upfront cost of the points to equal the savings you get on your monthly payment. This is called the break-even period.

In the example above, you’ll see that if you paid $2, 000 for one point to lower your interest rate 0.25%, you’d have a monthly payment savings of $30.55. To find the break-even point, you’d divide $2, 000 (the upfront cost) by $30.55 (the monthly savings), to see how long you’d have to live in your home for it to be worth the upfront cost. In this example, it would take 65.4 months to recoup the initial cost.

Considerations:

- The interest rate reduction you’ll receive for buying points can vary widely, depending on the lender and the marketplace

- Buying points may give you a tax benefit. Contact your tax professional to see how buying points might impact your specific tax situation.

- When buying a home, you will avoid the cost of private mortgage insurance (PMI) by making a down payment of at least 20%. If you need to decide between making a 20% down payment and buying points, run the numbers to see if paying PMI would cancel out the savings you’d get from buying points and lowering your interest rate.

- Points for adjustable-rate mortgages (ARMs) typically provide a discount on the loan’s start-rate during the initial fixed-rate period. Run the numbers to ensure that your break-even point occurs well before the fixed-rate period expires. For example, on a 5/1 ARM, you would typically want to recoup your costs within two years which leaves three years of both a reduced payment and an increased contribution toward your principal balance each month. If rates go up during the adjustable period, your rate will be lower than it would have been by the amount of the initial rate discount you received by paying points.

Getting help paying for points

Sometimes new home developers will offer to pay for points as an incentive to potential homebuyers. This can work to your benefit, particularly if you’ll be in the home for a long time. In addition, just as you may negotiate with a seller to pay your closing costs, you may ask a seller to pay for your points. This could save on the amount of cash you will need at closing. There are limits to “third party” contributions, so ask your lender for guidelines for the program you are considering.

Is buying points right for you?

To find out whether points could work for you, determine if you have the cash available to buy points up front in addition to your down payment, closing costs, and reserves. Also, consider how long you plan to own the home.