Low interest mortgage rates

Find answers quickly online

Find answers quickly online

With Rocket Mortgage℠ by Quicken Loans, our fast, powerful and completely online way to get a mortgage, you can adjust your mortgage options to find the lowest payment possible.

Start NowTalk to a Home Loan Expert

Not comfortable starting online? Answer a few questions, and we’ll have a Home Loan Expert call you.

Talk Now

Why spend more than you have to? Call (800) 251-9080 or fill out this form and we’ll call you.

All Fields Required

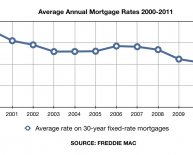

Incredibly low mortgage rates mean lowering your payment is easier than ever

- Why pay more than you have to? Don’t miss your chance to take advantage of mortgage rates at their lowest in several decades.

- Even changing the terms of your mortgage can maximize your monthly income.

- Check out our Refinance Calculator to see how a new rate and term could lower your monthly mortgage payment. Or learn how refinancing with PMI Advantage can save you money and taxes.

Every day, we help hundreds of Americans lower their monthly mortgage payment by refinancing. Contact us today and we’ll help you, too.

Why you should choose Quicken Loans

- Our exclusive online tools like MyQL let you track your mortgage process from start to finish, and our Mortgage Calculator app gives you rates right on your phone.

- With more than 30 years of experience, we’ve designed a mortgage process that adapts to your needs.

Our most popular loan options for lowering your monthly mortgage payment*

- FHA Loan – Refinance out of a skyrocketing mortgage payment with the fixed-rate security of a government-insured FHA loan. Find out if you could refinance without an appraisal with our easy FHA Streamline tool.

- Adjustable Rate Mortgage – Get the lowest rate available with a 5- or 7- year ARM and potentially pay thousands less over a traditional fixed rate mortgage for the first 5 or 7 years of your loan.

- VA Loan – Get a low rate and payment with the VA loan if you’re a qualified veteran, military member, or spouse. Ask us if you are eligible for the great benefits of a VA loan!

*By refinancing your existing loan, the total finance charges may be higher over the life of the loan

How do I know if refinancing to lower my payment is worth it?

You want to answer two important questions:

- How much will I save? A lot may have changed since you bought your home – your credit score, your home value, mortgage rates. If any of these have improved, you should definitely explore how much you can lower your payment with our refinance calculator.

- Will the savings cover the costs? It’s possible to add the costs associated with getting a new mortgage into the total refinance amount to avoid paying anything out of pocket at closing. However, refinancing in order to lower your payment may result in a longer loan term, and that might mean paying more in interest overall in the long run.

Talk to a Home Loan Expert or use our refinance calculator to see if refinancing your home can help you lower your payment.

What does refinancing mean? How can it get me a lower monthly payment?

Refinancing your home means taking on a new loan with different terms. To lower your monthly payment, you’ll need a loan that meets one or more of the following criteria:

- A Lower Interest Rate – The higher your interest rate, the more you’ll pay for your mortgage both now and in the future. A lower rate equals a lower payment if you don’t shorten the length of your mortgage term.

- Gets Rid of Private Mortgage Insurance (PMI) – If you put less than 20% down on your original home loan, chances are you’re paying private mortgage insurance (PMI). If your home has increased in value and/or you have enough equity, you can refinance to eliminate this costly monthly payment.

- Refinance to a Longer-Term Loan – When you refinance to a longer-term loan, you’re stretching the amount you owe over a longer period of time. While you might pay more in interest overall, your monthly payment will decrease.

What is equity? How can it help me lower my payment?

Home equity refers to the appraised value of your home minus the amount you still owe on your loan.