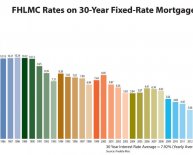

30 Year loans

Thirty-year fixed mortgage rates were sharply higher Wednesday, while 15-year fixed mortgages and 5/1 ARM rates moved up slightly, according to a NerdWallet survey of mortgage rates published by national lenders this morning.

Thirty-year fixed mortgage rates were sharply higher Wednesday, while 15-year fixed mortgages and 5/1 ARM rates moved up slightly, according to a NerdWallet survey of mortgage rates published by national lenders this morning.

This is the first significant move higher for 30-year home loans since a similar sharp increase was noted on Aug. 8.

Mortgage rates make a move

The NerdWallet Mortgage Rate Index compiles annual percentage rates — lender interest rates plus fees, the most accurate way for consumers to compare rates. Here are today’s average rates for the most popular loan terms:

Mortgage Rates: Aug. 17, 2016

(Change from 8/16)

30-year fixed: 3.63% APR (+0.05)

15-year fixed: 3.02% APR (+0.01)

5/1 ARM: 3.50% APR (+0.01)

Homeowners looking to lower their mortgage rate can shop for refinance lenders here.

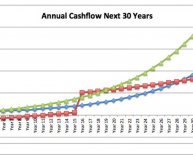

New housing construction continues to lag behind demand

The latest data on housing permits, starts and completions continue to reveal a disturbing trend: Construction is still falling behind rising demand. The July report, released Tuesday by the U.S. Census Bureau and the Department of Housing and Urban Development, shows substantial declines year-to-date in multifamily housing permits, with moderate gains in single-family permits.

“New construction is failing to keep up with household formation, meaning that the low vacancies in rentals and the tight supply of homes for sale will continue to be a key theme for housing in the months ahead, ” Jonathan Smoke, Realtor.com chief economist, said in a news release. “Single-family is continuing to show gains, but the gains in permits are weaker than the gains in starts. Builders are starting what they already permitted earlier this year but are not bullish about demand this fall and winter.”

NerdWallet daily mortgage rates are an average of the published APR with the lowest points for each loan term offered by a sampling of major national lenders. Annual percentage rate quotes reflect an interest rate plus points, fees and other expenses, providing the most accurate view of the costs a borrower might pay.

More from NerdWallet

Compare online mortgage refinance lenders