30 Year Conforming

What Is A Conventional Loan?

Conventional loans are growing in popularity thanks to low rates and increasingly flexible guidelines.

A conventional loan is one that is not formally backed by any government entity such as FHA, VA, and USDA. Rather, it is a loan that follows guidelines set by Fannie Mac and Freddie Mae, two agencies that help standardize mortgage lending in the U.S.

Conventional loans are also known as conforming loans because they "conform" to Fannie Mae and Freddie Mac standards.

Does the lack of government backing make conventional loans less desirable? Hardly.

While a conventional mortgage appeals to a wide demographic, it's especially good for first-time borrowers with decent credit and some amount of downpayment.

From the ten-percent-down piggyback loan to the three-percent-down HomeReadyTM and Conventional 97 loans, conventional low-downpayment options not only exist but are extremely popular with today’s buyers.

So, how do you qualify for a conventional loan? Simply by matching expectations set out by Fannie Mae and Freddie Mac.

Once you do that, you join the club of conventional loan homeowners who make up about 65% of the market.

What Are Conventional Mortgage Advantages?

Like most loans, you have an option about how long you will be paying your mortgage.

Conventional loans come in 15, 20, 25, and thirty year terms. Some lenders even offer 10-year conventional loans.

The shorter your loan term, the higher your monthly payment. Fortunately, a loan term of 30 years still comes with low fixed interest payments that help home buyers budget and cover the other costs of home ownership.

Adjustable rates are in fact fixed, but only for a period of time – usually 3, 5 or 7 years. During that initial “teaser” period, the homeowner pays ultra-low interest and can save thousands.

The glitch here is that if they don't sell at the end of the loan's life, the rate adjusts - maybe down, but also maybe up. It's a gamble that they should discuss with their lender and financial advisor.

Another advantage to conventional loans is the lack of an upfront mortgage insurance fee, even if the buyer puts less than 20 percent down.

FHA loans, plus USDA mortgages and even VA loans require an upfront “funding fee” usually between 1% and 3% of the loan amount.

Conventional loans only require a monthly mortgage insurance fee, and only when the homeowner puts down less than 20 percent. Plus, that mortgage insurance cost is often lower than that of government-backed loans.

Conventional loans are actually the least restrictive of all loan types, in some respects.

USDA loans require the property purchased to be in a designated rural area. This is fine for those who live and work in suburban and rural locations. However, for those in major cities, a USDA-eligible home could extend commuting distance beyond what is reasonable.

VA loans are exclusive to current and former military service members. They offer a lot of benefits, like zero downpayment and no monthly mortgage insurance. But they are not available to the general population.

FHA loans are a powerful home buying tool, but can come with high upfront and monthly mortgage insurance fees that are payable for the life of the loan - up to 30 years. The only way to cancel FHA mortgage insurance is to refinance out of the FHA loan. This can incur additional costs.

First-time and repeat buyers can land a good value when they choose a conventional loan for their home purchase. And, more buyers qualify for this loan than you might expect.

Today's Conventional Loan Rates

Conventional loans come with low rates that make home buying affordable.

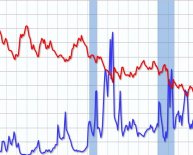

Rates are based on mortgage backed securities (MBS) which are traded just like stocks. And like the stocks, conventional loan rates change daily, and throughout the day.

What's the best way to secure a low rate? Watch market movements so you know a good rate when you see one.

What's the best way to secure a low rate? Watch market movements so you know a good rate when you see one.

Rates for 30-year fixed conventional loans have remained below 4.5% for some time, and rates are not expected to rise above that level in the near future. Still, the lowest rates are available to those who are ready to lock in when rates drop.

Locking a rate is available to any approved applicant who has selected a property to buy.

Short-term conventional loans come with very low rates. The most popular conventional loan lengths are as follows.

- 30-year fixed

- 15-year fixed

- 10-year fixed

Twenty and twenty-five year terms are also available from many lenders.

Don't rule out a conventional adjustable rate mortgage (ARM). These loans come with ultra-low rates for a period of typically 3, 5, or 7 years. They then adjust based on current rates.

Today's home buyers often choose a 5-year ARM or 7-year ARM. These loans can provide thousands in savings while giving the home buyer enough time to refinance into a fixed-rate loan, sell the home, or pay off the mortgage entirely.

It pays to get at least three written quotes from different lenders, no matter which loan length or conventional loan type you choose. According to one government study, applicants who shopped around receive rates up to 0.50% lower than non-shopping home buyers.

For instance, a home buyer with a 740 score and 20% down will be offered about 0.50% lower rate than a buyer with a 640 score.

It's important get a personalized rate quote. Published rate averages are often based on the "perfect" applicant - one with great credit and a large downpayment. Your rate might be higher or lower.

Get a conventional rate quote to based on your information, not on that of an average buyer.

How Do You Qualify For A Conventional Loan?

Conventional loans have a reputation of being too hard to qualify for.

That’s not the case.

Elements of approval are the same as those for “easy” government-backed loans: you need to prove you make enough money, that your income is expected to continue, you have enough assets to cover the downpayment, plus you have adequate credit history.

But it is true that lenders set a higher bar for conventional loan applicants than for other applicants - FHA buyers, for instance.

Conventional loans do not come with an implicit government guarantee that repays the lender if the buyer fails to do so. That comes with higher risk for - and therefore higher standards from - the lender.

Still, home buyers shouldn’t be scared away and assume they can’t qualify. Conventional loan qualification is not difficult for the average home buyer.

Credit

According to loan software company Ellie Mae, the average credit score for all applicants who successfully complete a mortgage is around 720. This is plenty high to get approved for a conventional loan.

The minimum accepted score for most conventional loans is 620. "We want to know that people pay their bills on time and are financially disciplined and good at money management, " says Staci Titsworth, regional vice president sales manager with PNC Mortgage in Pittsburgh, Pa. A slightly higher score may pass the credit-score test, but necessitate a higher interest rate to compensate for the greater risk.