The home mortgage company limited

Are you wondering if you can add your spouse to your home loan?

Are you wondering if you can add your spouse to your home loan?

Lenders generally don’t make it easy for you to modify your loan once it’s been taken out. However, just because you can’t add your new spouse to your loan doesn’t mean that he or she can’t be a part of your house’s ownership. You typically can add your spouse to your home’s deed without interfering with your loan. Adding your spouse, though, can have consequences that you may want to consider.

Adding Your Spouse to the Loan

When you took out your mortgage, your lender did a detailed review of your personal finances and determined if you could afford the home. Once you agree to the set terms proposed by your home mortgage lender, if can be difficult to change those terms. This means that, even if you live together, you’ll be the only one on the loan and responsible for it.

Refinancing With Your Spouse

The most effective way to truly include your spouse in the home loan is to refinance and take out a new mortgage together. Before doing this, you will likely want to check both of your credit reports to ensure there are no surprises when the lender reviews your credit usage. If you can qualify, you might be able to use the refinance to take out a loan with a lower rate or one with a shorter term that you can pay off in less time.

Adding Your Spouse to the Deed

If you want, you can usually add your spouse to your home’s deed – the document that grants ownership of the real estate. Your bank’s interest in the property will still come before your spouse’s, though, so if you don’t pay your loan, both of you can still lose the house. It is possible for your lender to object to you doing this in some limited circumstances, so you may want to touch base with a real estate attorney before doing so.

Leaving Your Loan Alone

Just because you get married doesn’t mean that you have to add your spouse to your loan or even to your deed. If something happens to you and he inherits the home, thanks to the Garn-St. Germaine Depository Institutions Act, the lender will have to let him take over the mortgage and its payments, so he won’t lose the house.

Also, while it might be painful to think of something going wrong with your marriage, adding your spouse to your deed without adding him to your loan could leave you in a bad situation if your marriage breaks up. It’s possible that he or she could get the house in a divorce proceeding but you could still end up liable for the loan.

As with any major home mortgage adjustment, be sure to consult a financial advisor and possibly an attorney to make sure the change is a good choice for you and your spouse. Any major change in the way you manage your personal finances between the two of you is an important decision and should be handled with care.

No Credit Card Required

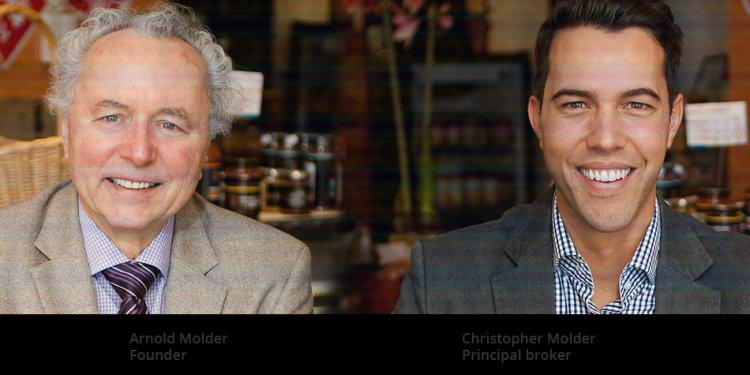

About the Author

has been a writer since 1996, with experience in the fields of financial services, real estate and technology. Poretsky holds a Bachelor of Arts in political science from Columbia University.

This article is provided for general guidance and information. It is not intended as, nor should it be construed to be, legal, financial or other professional advice. Please consult with your attorney or financial advisor to discuss any legal or financial issues involved with credit decisions.