Foreign nationals Mortgage

Correction: An earlier version of this story incorrectly described New Penn's lending practices and Moody's Investors Service's research on the company. New Penn never allowed foreign nationals to use assets as income, and Moody's published an "originator assessment" of the company but was not asked to rate its one securitization of loans to foreign nationals.

Correction: An earlier version of this story incorrectly described New Penn's lending practices and Moody's Investors Service's research on the company. New Penn never allowed foreign nationals to use assets as income, and Moody's published an "originator assessment" of the company but was not asked to rate its one securitization of loans to foreign nationals.

Home lending to foreign nationals is "an opportunity for us to get our capital out there and develop new relationships, " says Brian Constable, EVP and head of retail banking at CTBC Bank, formerly ChinaTrust Bank.

The anemic home lending market has prompted some banks to ratchet up lending to foreign nationals.

Lending to foreign nationals buying U.S. real estate has become a profitable niche akin to making interest-only loans or jumbo loans to wealthy, high net-worth borrowers. Because foreign borrowers typically do not have a traditional FICO score, such loans do not conform to mortgage regulations that went into effect in January, so they do not have the ultra-safe "qualified mortgage, " classification.

But in the current tough lending environment, some banks are still willing to take that risk. Loans to foreign nationals typically require downpayments of 25% to 30% and plenty of cash on hand in a current account. Some lenders think that honing their expertise at identifying foreign borrowers that they consider good credits will help them do so for other borrowers. Picking up the deposits of foreign nationals also gives banks a chance to cross-sell products.

"It's an opportunity for us to get our capital out there and develop new relationships, " says Brian Constable, an executive vice president and head of retail banking at .5-billion-asset CTBC Bank, formerly ChinaTrust Bank, in Los Angeles.

CTBC saw a 133% jump in lending to foreign nationals last year compared to a year earlier, through its 12 branches in Los Angeles, New York and New Jersey, Constable says. Financing is available for up to 70% of the purchase price for three-year to five-year loans.

CTBC saw a 133% jump in lending to foreign nationals last year compared to a year earlier, through its 12 branches in Los Angeles, New York and New Jersey, Constable says. Financing is available for up to 70% of the purchase price for three-year to five-year loans.

Though most banks want three to five years of credit history, CTBC may take just one year because it can pull the credit history of the borrower by tapping their assets and liability from its Taiwanese parent CTBC Bank, the former Chinatrust Commercial Bank.

"These borrowers may have a significant downpayment of 30% to 40%, they have been in the U.S. for a couple of years and we can look at their bank statements and income in their accounts to make sure they have the ability to make those payments going forward, " Constable says.

Peter Alongi, a specialized mortgage sales manager at HSBC New York, says loans to foreign nationals represented 25% to 30% of HSBC's residential lending volume last year. China represents the biggest opportunity for the international bank, and he believes the Chinese government may loosen restrictions on private citizens from taking more than $50, 000 a year out of the country.

The international bank with offices in 81 countries requires a minimum downpayment of 25% and will lend up to $3 million. But borrowers must maintain a premier relationship with the bank by having at least $100, 000 in an account.

"The intention here is to maintain these customers on balance sheet, and service them from a wealth perspective. We want to be their financial advisor, " Alongi says. "The foreign national buyer is an intricate one and has to be understood as far as risk."

HSBC has an internal process whereby it creates a foreign credit report for foreign national borrowers based on their income, assets and liabilities that fall outside the U.S., he says. This assessment, combined with high downpayments, ensures the loans are far less risky and gives the bank confidence of the borrowers' ability to repay the loan.

HSBC has an internal process whereby it creates a foreign credit report for foreign national borrowers based on their income, assets and liabilities that fall outside the U.S., he says. This assessment, combined with high downpayments, ensures the loans are far less risky and gives the bank confidence of the borrowers' ability to repay the loan.

Some mortgage lenders such as New Penn Financial, a unit of Shellpoint Partners, the New York firm backed by the mortgage-bond pioneer Lewis Ranieri, have securitized loans to foreign nationals in the past. But investorstypically want a discount whenloans to foreign nationals are included in securitizations, which has put a kibosh on securitizing such loans as an exit strategy, some experts say.

Home sales to nonresident foreigners made up just 5% of the all U.S. home sales. But some markets like Florida have been dependent on foreigners to spur a housing recovery. Roughly 20% of home sales in Florida were estimated to have been made to non-resident foreigners in 2013, but 82% of those were all-cash buyers, according to a report last year from NAR. The majority of international buyers are concentrated in five states: Florida, California, Texas, Arizona and New York, NAR has found.

Jed Smith, an economist with the National Association of Realtors, says most foreigners have to have an existing relationship with a bank to facilitate getting loan otherwise it can be "very, very difficult, " which is why so many foreign nationals purchase U.S. property with cash.

"Sixty percent to 70% of foreign buyers do not get loans and that's why many are all-cash borrowers, what we refer to as high rollers, " Smith says.

Judy Hamblen, a Fort Lauderdale, Fla., mortgage broker with Sentrix Financial Services, says banks are missing out on making loans to foreign nationals, which represent roughly $68 billion a year in total mortgages in the U.S.

"There are an awful lot of foreigners buying with all cash partly because they can't get a loan, " Hamblen says. "Community banks have the ability to portfolio these loans. I smack my head thinking how much income that could generate for people in the (mortgage) industry, and how it could help the borrower preserve capital. When you're putting a 25% downpayment, in some respects it's a safer loan than a Federal Housing Administration loan."

Though CTBC kicked off its foreign national program in 2009, in the middle of the housing downturn, the alternative full-documentation loan program really took off last year. Constable says CTBC had "the best six months in mortgage funding in the history of the bank, based on loan volume and the amount of files we closed. It looks and smells like a standard loan program."

Bill Owen, CTBC'sfirst vice president and mortgage operations manager, is looking to create a similar product for owners of apartment buildings with up to four units, and potentially expand the product more broadly to other customers.

"We're looking at ways, as are other banks, to work within the guidelines, " says Owen.

Rick Soukoulis, the CEO of Western Bancorp, a California wholesale lender, says he is originating five-year adjustable-rate mortgages to foreign nationals that have had a job in the U.S. for two years. He sells the loans to credit unions.

"If they've been here working with money in the bank, we like 'em, " he says.

New York Community Bancorp will not receive regulatory approval for its deal to buy Astoria Financial by the end of the year...

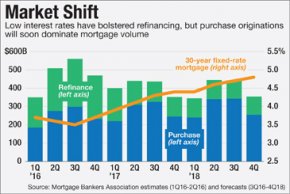

While mortgage rates moved somewhat higher in the period before the election, after the results were known, the yield on the...