Loan types for Homes

FHA loans allow many homeowners to buy homes they otherwise could not.

FHA loans allow many homeowners to buy homes they otherwise could not.

The Federal Housing Administration (FHA) was formed in 1934 to help people buy homes. The FHA itself does not make loans but it does insure the loans that private lenders make to homeowners who buy homes, reducing the lenders' risk. An FHA loan almost always has a lower interest rate, can be a fixed rate loan or adjustable and has lower down payment requirements than conventional loans do.

Types of Homes

The FHA mortgages are made for all kinds of properties like townhomes, condos, and single-family homes. The FHA will insure loans made for mobile homes as long as the owner owns the land on which the home will sit. The FHA will also insure loans for buying vacant land, but the borrower must demonstrate that he will build a home on the property and live in it. FHA loans for attached homes are less straightforward than they are for single unit properties. The attached property needs to be approved by FHA, and 80 percent of the units within the project need to be owner occupied.

Down Payments

The FHA has some of the lowest down payment requirements in the lending industry. They require 3 percent down for borrowers with good credit and 10 percent down for buyers whose credit score is below 580. Unlike some loans, the buyers cannot fold the closing costs when purchasing single-family homes into the mortgage, even if the total does not exceed the ceiling for the loan limits the the San Francisco metro area. Under some conditions buyers of attached products may be able to include the closing costs in their loans.

Interest Rates

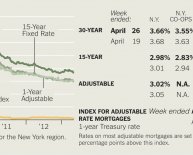

Because the FHA loans are insured by the Federal Housing Administration, their interest rates are typically lower than conventional or non conforming loans. Interest rates vary by lender, location, and the credit score of the borrower. The better the credit, the lower the interest rate.

Loan Limits for Single-Family Dwellings

The FHA sets ceilings on how much people can borrow to qualify for an FHA loan. The loan rates are set by housing market to allow for regional housing market conditions. The loan limits for an FHA loan in the San Francisco market are set at $729, 750 as of July 2010.

Loans for Attached Properties

FHA will insure loans for attached homes as long as the property has been approved for FHA lending. The FHA programs are geared for buyers who could not otherwise get other financing to buy an affordable attached unit. Unlike the single-family homes, some people may qualify to include the closing costs as part of the mortgage. The loan amounts for attached products are calculated on a building basis, not as a single unit. As of July 2010, the maximum amount FHA will allow for a duplex is $934, 200; the amount for a triplex is $1, 129, 250; a fourplex carries a limit of $1, 403, 400.