10 Years fixed mortgage

Myth: "I'll get a 30-year mortgage, but I'll pay it like a 15-year mortgage, so if something goes wrong I'll still have wiggle room.

Truth: Something will go wrong. Avoid 30-year mortgages.

If you say, "Cross my fingers and hope to die, I promise, promise, promise I will pay extra on my mortgage because I am the one human on the planet who has that kind of discipline, " you are kidding yourself.

Sick children, bad transmissions, prom dresses, high heat bills and pet vaccinations come up, and you won't make the extra payments. The FDIC says that 97.3% of people don't systematically pay extra on their mortgages.

Local experts you can trust.

Find an ELPThe ideal way to buy a house is the 100% down plan—pay cash for the whole house. Sounds weird, doesn't it? But think how much fun that would be! No mortgage! No payments! If paying cash for a house seems too far out of reach, you can still buy a house if you make wise choices.

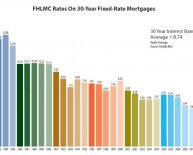

Save a down payment of at least 10% on a 15-year (or less) fixed-rate mortgage, and limit your monthly payment to 25% or less of your monthly take-home pay.

You can probably qualify for a much larger loan than what 25% of your take-home pay will give you. But it's not wise to spend more on a house because then you will be what Dave calls "house poor." Too much of your income will be going out in payments, and that will put strain on the rest of your budget. You won't be able to save and pay cash for furniture, cars and education.

The really interesting thing about 15-year mortgages is that they always pay off in 15 years. Thirty-year mortgages are for people who enjoy slavery so much they want to extend it for 15 more years and pay thousands of dollars more for the privilege. If you must take out a mortgage, pretend only 15-year mortgages exist.

Many people hang on to their mortgage instead of paying it off early because they're convinced they will get a tax advantage. If you're keeping your mortgage in order to get a tax cut, that's just dumb. Don't fall for that myth; the math just doesn't add up.

And, whatever you do, never buy a trailer, mobile home or timeshare. The value of these properties drops like a rock. You will never get back what you put into them.

Try Dave's easy-to-use calculator to help make home ownership a blessing, not a curse, for you. It will tell you how long it will take to pay off your house at your current rate, how much you can save if you make extra payments, and how much more you can pay off if you stop eating out for lunch every day. We're confident this is the best mortgage calculator out there today.

Find an ELP