Lowest Mortgage loan

VA Loans: No Mortgage Insurance Required

Many VA borrowers say that buying a home with no money down is the VA program’s biggest advantage. But there are other characteristics of a VA mortgage that provide huge benefits as well, especially compared to other available financing options.

With VA loans, closing costs are often lower, there’s less stringent underwriting, and mortgage rates are extremely competitive.

VA mortgage rates are typically 0.375 percentage points below conforming mortgage rates, and are lower than comparable FHA mortgage rates, too.

Another big advantage of VA loans that's often overlooked is the absence of a monthly mortgage insurance payment.

Let’s take a closer look.

Mortgage Insurance Basics, By Loan Type

Mortgage insurance typically comes into play when borrowers have a loan-to-value of 80 percent or higher. This form of insurance gives lenders the confidence and flexibility to lend to buyers with less skin in the game.

Borrowers pay the premium and in return are allowed to put less down. The premiums can be one-time charges, paid monthly or both in the instance of FHA and USDA loans.

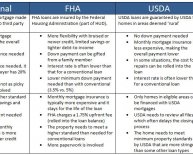

Conventional Mortgage Insurance

Conventional loans require a minimum 5 percent down payment. Consumers unable to put down at least 20 percent will usually have to contend with private mortgage insurance (PMI).

PMI rates on conventional loans will vary depending on several factors, like your credit score, your down payment, the loan amount and others. Conventional PMI is typically anywhere from 0.5 percent to 1 percent of the loan amount, and paid as part of your monthly mortgage payment.

For example, on a $200, 000 loan, that’s anywhere from $1, 000 to $2, 000 in annual PMI costs. Given that range, you could be adding anywhere from $83 to $167 to your mortgage payment each month.

Conventional borrowers typically pay PMI until they establish their loan-to-value ratio reaches 80 percent.

FHA Mortgage Insurance

FHA loans require a minimum 3.5 percent down payment and the program collects both an upfront mortgage insurance premium as well as an annual premium. The upfront portion is added to your loan balance, while the annual fee is typically spread across your monthly mortgage payments.

FHA mortgage insurance premiums (FHA MIP) are subject to change. The upfront fee is currently 1.75 percent of the loan amount. For FHA borrowers making that minimum down payment, the annual mortgage insurance premium is 1.35 percent.

Using that same $200, 000 loan example, the upfront MIP would be $3, 500, which is added to the loan amount for you. The annual MIP fee add approximately $225 to each of your monthly mortgage payments.

USDA Mortgage Insurance

The USDA Rural Development program is the other government-backed loan option offering 100 percent financing. This unique loan option can be used to purchase or refinance properties in qualified rural areas.

Like FHA loans, USDA loans feature both an upfront and an annual mortgage insurance charge. The upfront fee of 2 percent is added to the loan balance. The annual MIP fee is currently 0.50 percent.

On a $200, 000 loan, the upfront MIP charge would be $4, 000. The annual MIP on a USDA loan would add about $85 to your monthly mortgage payment.

VA Mortgage Insurance

Qualified VA borrowers in most parts of the country can purchase up to $417, 000 without having to factor in down payment. Regardless of the loan amount, one thing they won’t have to factor in is mortgage insurance.

For a VA buyer looking at a $200, 000 purchase price, the benefit of "not paying mortgage insurance" can bolster buying power, and, as compared to a comparable FHA loan, save a buyer as much as $225 per month in extra costs.

VA loans do come with a one-time funding fee which most borrowers choose to add to their borrowed loan amount. The funding fee cost for most first-time VA buyers is 2.15 percent of the loan size, which amounts to $4, 300 on a $200, 000 loan.

Borrowers with a service-connected disability are exempt from paying the funding fee entirely.

Get A Mortgage Rate Quote Now

Today's mortgage rates are near their best levels of the year and of all-time. And, for VA buyers, the ability to skip on mortgage insurance premiums helps to keep overall payments even ultra-low.

See whether you're VA loan eligible and how current mortgage rates can help. Rates are available online at no cost and with no social security number required to get started.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.