Mortgage Affordability Calculator USA

744

Today we are going to teach you how use the BeSmartee Mortgage Affordability Calculator.

Let's get started!

Step 1: Gross Income

You will start with your gross income to determine how much of a mortgage payment you can afford.

You will see a space available to enter gross monthly income. This is your monthly income before any taxes or deductions are taken out of your paycheck .

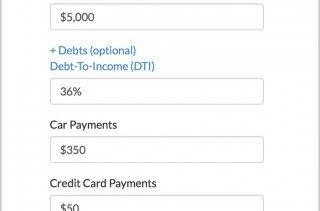

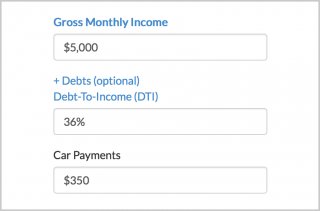

In our example we will assume there is a $5000 a month gross income.

Step 2: Debt-To-Income Ratio (DTI)

Next, you want to click on additional “Additional Debts”. Under debt-to-income ratio (which is calculated by dividing your monthly debts by your monthly income) enter your current debt-to-income ratio - without any mortgage payment included. In general, what you want to enter here is the debt-to-income ratio your lender is comfortable lending.

In many cases, the majority of lenders are most comfortable with a 36% debt-to-income ratio. Some lenders may allow you to go higher. Some may expect you to have a lower ratio.

In many cases, the majority of lenders are most comfortable with a 36% debt-to-income ratio. Some lenders may allow you to go higher. Some may expect you to have a lower ratio.

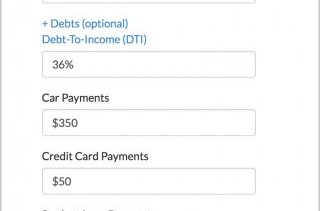

In this example, we will assume a 36% debt-to-income ratio.

Step 3: Car Payments

Next, we want to enter car payments. This does not include tax and insurance payments associated with your car. Simply, enter the car payment for the particular loan on your vehicle.

In this example, we will assume 0 month car payment.

Step 4: Credit Card Payments

Step 4: Credit Card Payments

Next, we want to enter your credit card payments. You may be making more than the minimum monthly payments on your credit cards. However, you want to enter the minimum monthly payment you’re required to make.

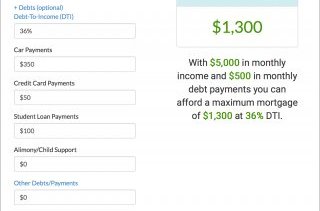

In this example, we will assume you have one credit card with a $50 a month minimum payment.

Step 5: Student Loans Payments & Other Debts

Next, you want to enter any student loan payments you are making. In this example, we will assume you are making a $100 a month student loan payment.

We will assume there are no alimony or child support payments, any other debts you have or experiencing any loss from rental income.

Based on this calculation: With a $5, 000 a month income and $500 a month in debt payments – you can afford a maximum mortgage of $1, 300 at a 36% debt to income ratio.

The Video

We took the above steps and created a short video. Click on the image below to view a video tutorial of our mortgage affordability calculator.

That's It!

How much of a home you can afford is determined by each lenders debt-to-income ratio guidelines. DTI is simply your monthly debt commitments divided by your monthly gross income. Borrowers with a lower DTI will receive lower rates and better loan terms.